Markets Update

Global equity markets had a meaningful decline last week, with U.S. equity markets seeing their steepest one week decline since 2008. This was in reaction to fears that the rapidly spreading Coronavirus (Covid-19) has and will continue to disrupt global commerce and will stop or slow the economic expansion we’ve enjoyed for over a decade. From peak-to-trough, the S&P 500 declined by about 14%. In response, Federal Reserve Chairman Jerome Powell said the Fed is ready to act to stabilize the economy if necessary, and other global central bank leaders from the developed “G7” countries echoed that sentiment. Shortly after that joint statement from global central bankers, the Federal Reserve cut the target benchmark rate by 50bps, a larger and faster move than was priced into markets just a short week ago. Between the flight to safety and anticipated rate cuts, the 10-year Treasury yield hit an all-time low.

Historical Context

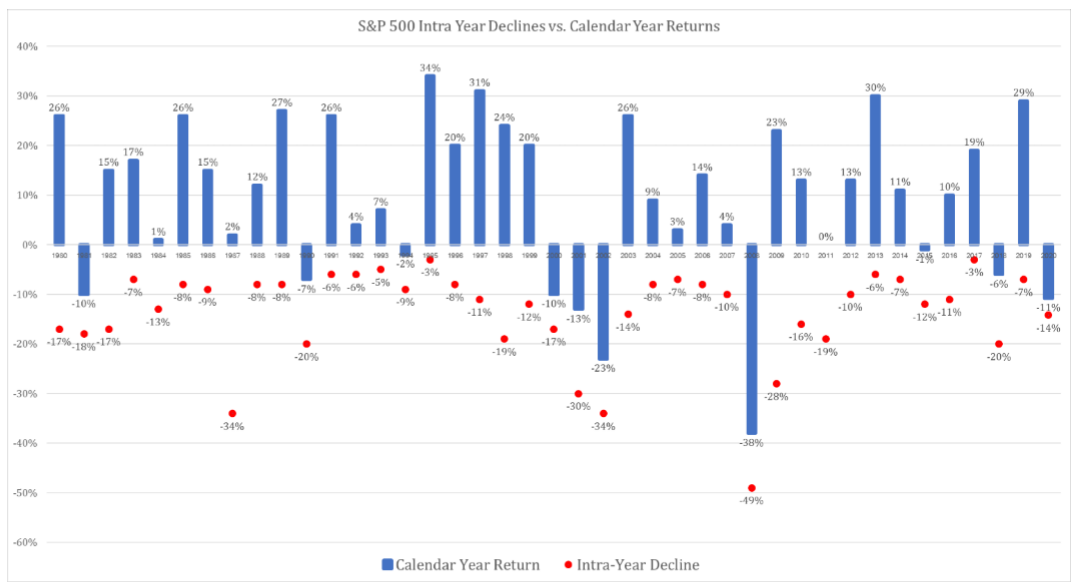

While these moves in the markets feel extreme in the moment, history shows us that this magnitude of drawdown is fairly “average”, though the rapidity with which markets react today paired with the 24/7 news cycle can make that perspective hard to maintain. Since 1980 the S&P 500 has seen average annual returns close to 9%, but during that same time period, the average peak-to-trough drawdown during a calendar year has been just short of 14%, almost exactly what the current peak-to-trough drawdown has been. In 14 years since 1980, we have seen larger intra-year drawdowns than the current decline. The chart below shows this data, with the calendar year returns for the S&P 500 in blue, and the largest intra-year drawdown shown in red. The final bar shows this year through February 28th with the market down 11% and the maximum drawdown of 14%.

Source: Bloomberg Financial, S&P 500 Price Return

Our Approach

The inherent volatility of stock markets is exactly why we seek to allocate across many different asset classes and strategy types. Within client portfolios, we seek to minimize the reliance on equity market performance in meeting return targets. When we talk about risk tolerance, often the focus is on the emotional response to moves like the current (or larger) drawdowns. While some investment in equities is an important part of an investment portfolio, there is also the need to take less correlated risks to more predictably meet the goals and obligations of each client. Large drawdowns in portfolios can create problems beyond emotional distress, especially for those clients who are drawing from their portfolios to fund their lifestyle. In constructing portfolios, it is important to consider both the ability and willingness of each client to take risk so that when we see these types of declines, which are to be expected, we can stick to the long-term plan.

Through this decline, we have seen other asset classes and strategies outside of equities hold up well. Our allocations within fixed income have seen very little movement in their performance over the past few weeks, either positively or negatively. In speaking with several of our managers in the hedge fund space, we found that there has not been any major de-risking to date and that several strategies have managed to make money in this downturn. In terms of private investments across real estate and various lending strategies, the immediate effect of this type of market move is immaterial. There would need to be a severe and prolonged decline in the economy before we would need to reset any return expectations for these alternative investments. For us, the attractiveness of these strategies was their lack of correlation to equity markets as well as minimal sensitivity to the broader economic. We have heard from managers across these asset classes that the recent dislocation has provided better entry points to put more capital to work. Our investments across these asset classes have been selected based on a priority of capital preservation, and many include a cash flow component which generally increases the stability and predictability of returns.

Looking Ahead

As with any exogenous shock we might face, we will be watching how the Coronavirus and the reaction of governments and corporations impact market fundamentals. Given we were already ten years into this market cycle, we had already limited our exposure to strategies that would have underlying cyclical risks. Over the course of the last several years, our research team has gone to great lengths to try to find niche strategies that have more strategy-specific return drivers. In addition, in the credit space in particular we have attempted to be conservative in our use of leverage to generate more return in what has been a compressed credit spread environment. To the extent that recent financial market volatility persists, some of the more leveraged operators in the credit markets may be forced to bring down that leverage at an inopportune time. This could produce more potential investments in the traditional stressed and distressed credit space which we would be particularly excited about. All that to say, our team is keenly focused on where we have exposure to this market volatility but also where it may be producing outsized opportunities.

Vivaldi Operational Update – Potential Impact to Business Continuity

In addition to providing a timely market update, we feel it is equally as important to share how Vivaldi is positioned from an operational and business continuity perspective. We have determined that COVID-19 would fall under the broad category of ‘Office Inaccessibility’ within the context of our Business Continuity Plan, should conditions rise to the level of an emergency in any area we have offices located. Accordingly, all Vivaldi employees are properly equipped to work effectively and safely from their home for extended periods of time utilizing our secure and robust multi-factor authenticated systems. Furthermore, Vivaldi clients will have continued access through our various portals with an internet connection. Given our operational setup, we are confident in our ability to continue to support our clients and maintain a safe working environment for our employees. We will continue to monitor the status and progress of this outbreak, including any impact to our business, and will provide future updates as appropriate.

Click here to download a PDF copy of this update.