Business Continuity

Amidst these unprecedented times, our primary focus is to deliver our clients the same wealth management experience they have come to expect. For the last week, our entire organization has worked remotely, and we are grateful for the energy they have committed to maintaining our strong corporate culture. We have scheduled additional internal meetings during this period to ensure that we are effectively communicating within and amongst our functional teams. Below is a quick update:

- Our Advisory Team is well equipped for video conferencing and screen sharing so you can continue to have productive and interactive one-on-one discussions about your personal situations – just ask and we’ll set something up!

- The Client Service Team is fully operational to handle the day-to-day operations of servicing your accounts as well as those “above-and-beyond” requests.

- We encourage you to reach out to ClientService@vivaldicap.com

- Or call 312.248.8300

- The Investment Research Team has been continuously monitoring our active investments as well as evaluating the go-forward opportunity set this market dislocation has presented. The team has had multiple touch points with external managers over the past several weeks to get current information and market intelligence at a time when many other advisors cannot get their phone calls answered or returned. Due to our extensive relationships with underlying managers, the research team has even been able to schedule multiple firm-wide update calls with portfolio managers of various strategies to provide insight from the “front-lines” for the benefit of our advisors and clients. The team is working diligently to keep advisors and clients informed in this volatile market. The diligence the research team completes, and the correspondence you receive on existing investments, will continue.

We are proud of our employees and the extra effort they have made to support our advisors and clients during this unusual time. We have also been pleased with the performance of our vendors as we have not had difficulty with connectivity or accessing information. Our timeline for operating under this new normal is currently unknown and we will continue to seek the guidance of health officials to ensure that we are doing all that we can for those who are vulnerable in our many communities.

Markets Update

Since our last letter the sell-off in global markets has continued and the impact has now spread across all major asset classes. The S&P 500 has now declined 30% peak to trough and has done so quickly, in only 18 trading days. Our lives have changed too — grocery stores struggle to keep shelves stocked as we have all undertaken social distancing, sacrificing our routines and conveniences in an effort to slow the COVID-19 Pandemic. These are uncertain times and the markets hate uncertainty. At this point, the key economic uncertainty is how long we will need to be on lockdown to stop or slow the spread of the virus and what impact that will have on various industries where revenue goes to zero or near zero in the near-term. When the future profitability of a company or asset is uncertain it is difficult to know how to value it, and the instinct is to sell. That selling is now widespread as nearly all fixed income outside of Treasuries has sold off dramatically. The liquidation pressure has been fairly indiscriminate across credit quality and relative seniority in the capital structure.

The Federal Reserve and other Central Banks continue to purchase assets in order to stabilize markets. On Monday, the Fed expanded lending programs to allow for high grade municipal bonds and corporate debt to serve as collateral. Additionally, the Fed said it would begin purchasing commercial mortgage backed securities as a further example of bringing their monetary policy might to bear. Congress and the Treasury are working further on ways to provide relief to workers and businesses through fiscal policy.

Historical Context

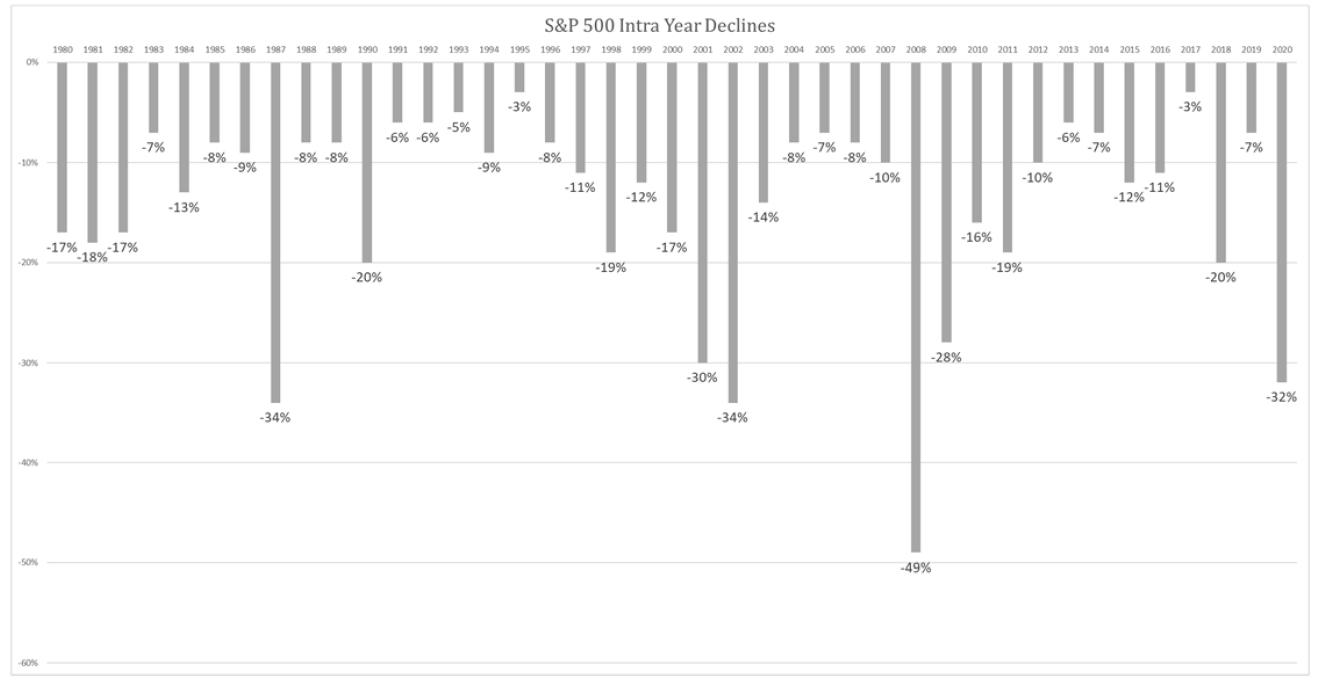

In our last note we detailed how intra-year drawdowns for the S&P 500 have averaged 14% since 1980; we’ve

now doubled that. As seen below, this drawdown is now in rare company that includes the ’87 Crash, the Dot

Com Crash and 2008.

Source: Bloomberg Financial, S&P 500 Price Return (through 3/20/20)

Source: Bloomberg Financial, S&P 500 Price Return (through 3/20/20)

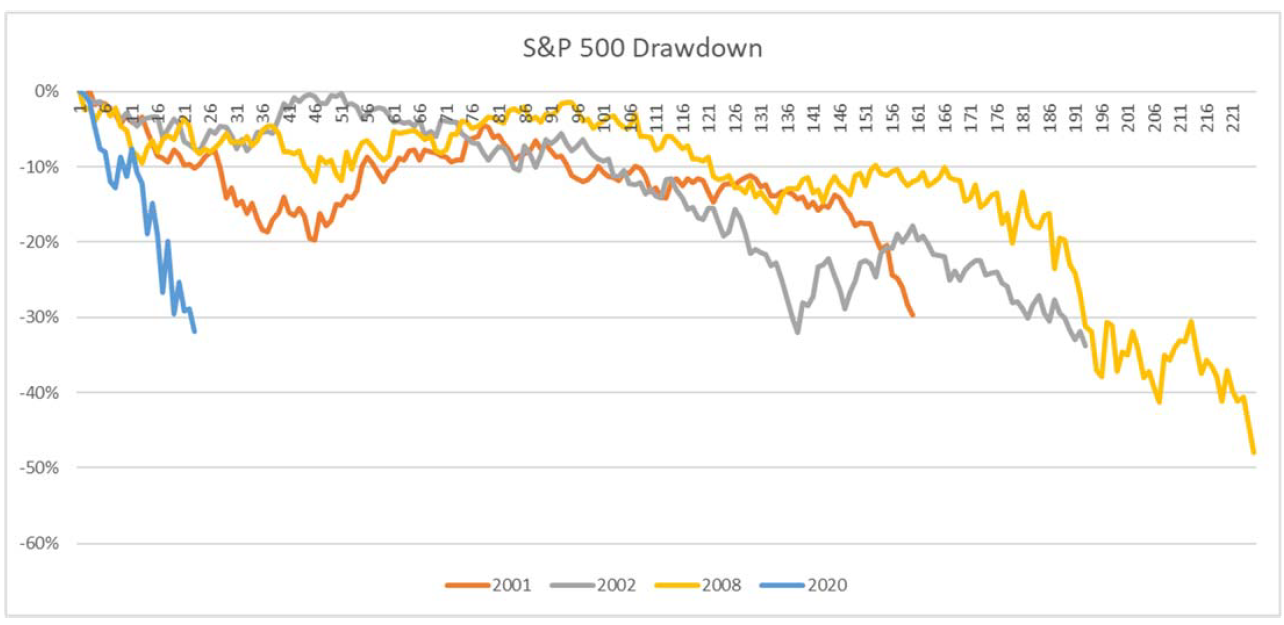

The speed of the decline from the peak has been quick relative to past declines of this magnitude or greater. In the Fall of 2008, following the collapse of Lehman Brothers, the market fell 30% in 19 days (9/19/2008-10/15/2008), one day longer than it took this time, though the market had already declined 20% from its peak by that point. The current drawdown compared to the three most recent drawdowns of this magnitude or greater are shown below in relation to the number of trading days between peak and trough. This rapidity is clearly a reflection of the uniqueness of a health-related economic event as well as the level of uncertainty around this event’s severity and duration.

Source: Yahoo! Finance, S&P 500 adjusted close prices (3/20/2020)

Source: Yahoo! Finance, S&P 500 adjusted close prices (3/20/2020)

Interest rates have stayed near all-time lows in U.S. Treasury Bonds, but all other areas of fixed income have joined the sell-off. In speaking with fixed income managers, a consistent theme has been that there has been indiscriminate selling of any bond where a bid can be found. This problem has been exacerbated by liquid index funds in fixed income that are forced to sell as their investors redeem; those managers have been selling the most liquid bonds first. Ironically the bonds with the best liquidity tend also to be the highest quality bonds. Investors have long relied on high quality bonds to ballast a portfolio when risk assets are selling off. Amidst the turmoil of the last few weeks, there are funds that are being forced to liquidate as their investors redeem, adding pressure to liquid markets and securities. We have seen sectors within fixed income trading at levels that imply widespread municipal bankruptcies and recovery rates on corporate debt multiples lower than the worst we saw in 2008. It is worth noting that this is why we have intentionally (1) accessed the bulk of our credit investments via less liquid structures that don’t have to participate in this forced liquidation and (2) generally avoided leverage in these credit investments, even as the average credit firm added material leverage to strategies in an effort to generate additional return to counteract the tight credit spread environment that we were in just two weeks ago.

Daily Liquid Structures: An Asset/Liability Mismatch

History shows us that in the beginning of a panicked sell-off investors will indiscriminately sell what they can, not necessarily what they think is the riskiest asset they own. We have certainly seen that in this market as some areas of fixed income selling to levels that imply defaults and loss severities that would be many magnitudes worse than what we saw in the Financial Crisis of 2008. In anticipation of a greater sell-off, we held cash in several of our fixed income strategies and have been slowly investing that cash in some of those portfolios where we are seeing distress levels greater than we observed in 2008.

As we noted above, in recent years, where we have taken directional credit risk we have attempted to do so in vehicles such as closed-end funds and interval funds that have less liquid features that allow those underlying investment managers to play offense in periods like today (as opposed to being part of the liquidation pressure themselves). Daily liquid mutual funds and ETFs that own multi-billion-dollar portfolios of fixed income have been living in a negative feedback loop of their own doing, where they have to liquidate their portfolios to meet investor outflows, only to put more pressure on those same bond holdings, worsening their own performance and creating more investor outflows. Said differently, the managers of those daily liquid structures have effectively no choice but to provide liquidity to investors who seek it. To do so, ETF and mutual fund managers become “forced sellers” and offload vast quantities of debt instruments, taking extremely depressed pricing bids simply because they have to meet redemptions. The important point to remember is that the market pricing of those assets is not necessarily reflecting the fundamental value of these assets but it is reflecting the daily price from being forced to liquidate these assets.

While the mark-to-market we have seen is never enjoyable, the fact that our underlying fixed income teams are not forced to liquidate holdings at what are very likely to be uneconomic prices gives us some confidence that much of this mark-to-market pressure will be able to be recovered. Anecdotally, we have heard from managers that the selling has been indiscriminate regardless of quality of paper, such that investment grade municipal bonds have seen 15-20% pricing declines. While municipalities’ finances will certainly be stretched by this economic downturn, if investment grade municipal bonds are really worth 80% of face, then investment grade corporates are worth less, high yield bonds are worth much less, and equities worth still even less. While no one can predict much of anything with precision at this exact moment, we at least have the ability to see these portfolios through to their fundamental value as opposed to desperately searching for a bid in a market with precious few.

Risk Tolerance

While risk is multifaceted, we spend a good deal of effort trying to determine our clients’ risk tolerances which can change with time and circumstances. We want to take enough risk to meet each client’s goals without tipping the scales. It is not well understood that risk tolerance is really two measures: ability to take risk and willingness to take risk. When constructing portfolios for clients we consider both, but we start with an investor’s ability to take risk. The ability to take on risk is a mathematical process ensuring that when a large market drawdown occurs, a client can still take the cash flow they need off of a smaller portfolio and not run out of money over their expected lifetime. An investor’s willingness to take on risk in their portfolio is more subjective and is complicated by the fact that an investor’s confidence grows as time passes since the last large drawdown. These markets are certainly a sobering check on anyone’s willingness to take risk in their portfolios. We remain confident in our processes to assess our clients’ ability to take on the drawdowns we’re seeing and still meet their long-term goals and obligations.

Final Thoughts

While it is impossible to know the exact timing, extent, and breadth of drawdowns like this, we always consider these market conditions when making investment and allocation decisions. While there is nothing we can do about investments and strategies being marked-to-market, we attempt to do everything possible to minimize capital losses. This means starting with investments and managers that have fundamental attributes that allow for better protection in economic and market downturns. We couple that with selecting managers with the right investment vehicle for their strategy, allowing the manager to avoid being a forced seller in panicked markets. Each client is then allocated to these strategies based on their specific circumstances and goals. We believe that performing extensive due diligence, customizing allocations, and investing alongside our clients in the same strategies at the same terms is the only way to truly fulfill our fiduciary responsibility to you.

Click here to download a PDF copy of this update.