Market Perspective

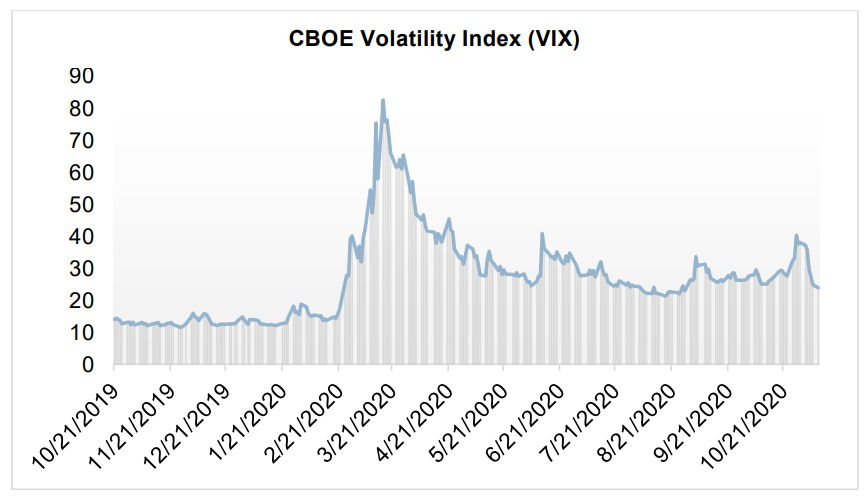

For regular patrons of our quarterly update, you will notice that we are sending this correspondence several weeks later than normal. In part that is because our team, somewhat counter-intuitively in a global pandemic, has never been busier. The delay, however, has also been intentional as we did not see much, if any, value in providing our thoughts on financial markets and the investment landscape mere weeks away from a U.S. Presidential election which was nearly certain to shift that landscape materially. With the common refrain from Vivaldi that we are not particularly talented at top-down macro thinking, nor do we strive to be, we are at least cognizant of binary situations that limit our ability to be thoughtful when it comes to expressing our views on markets and opportunity set. With that said, while the formal conclusion of the election remains in process, we certainly think enough of the election-related uncertainty has passed for us to articulate a view that is more than a macro-driven guess. That uncertainty has clearly played out in the market as we write this letter, as judged by implied volatility measured by the VIX.

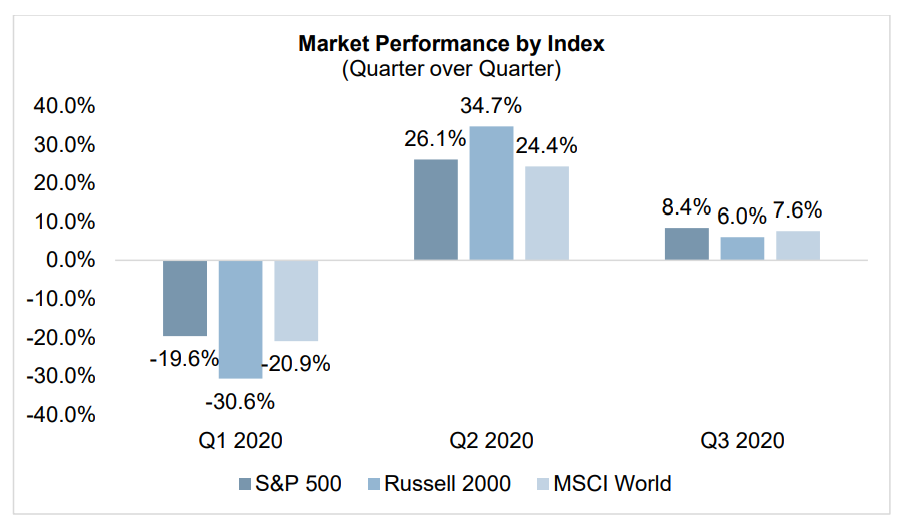

Even before the rally that we are seeing extend today, the story of 2020 after we explored March lows has been one of broad healing in risk markets. Equity markets wasted very little time in recovering all or at least the vast majority of Q1 drawdowns and are now sitting at or mere points below all-time high levels.

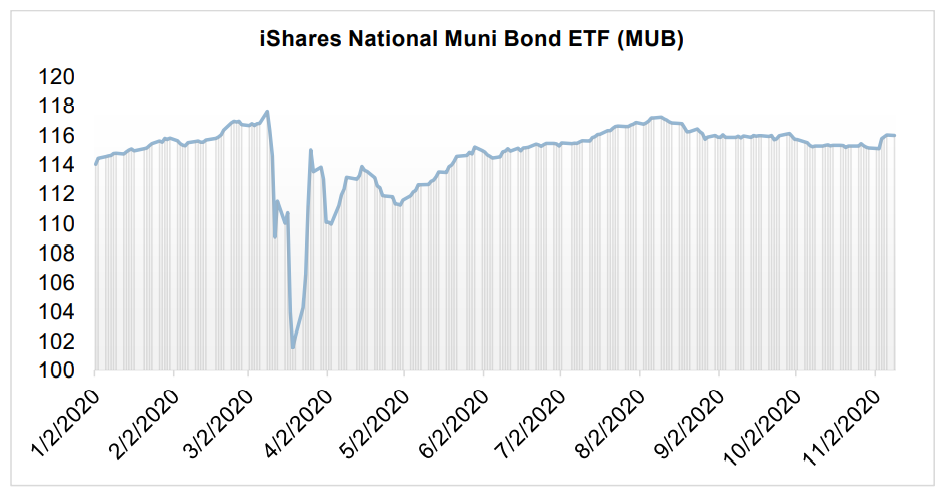

The area of the market that has had much greater dispersion in the path of recovery has been credit and fixed income markets. In our last letter, we chose to highlight the municipal bond market as one sub-sector to contrast against the snap-back rally of equity markets. We chose that comparison because, to us, it exemplified how differing liquidity profiles across market sectors are critical to analyzing periods of severe market stress. That is not a novel or particularly insightful view, but it is something that we keep forefront in our minds when we are in the midst of volatile periods. Some of the best opportunities that we and our managers exploited in the first half of the year were in the investment grade municipal bond space. As seen in the broad-based MUB ETF below, the recovery in the sub-sector took longer than several equity benchmarks, but on a risk adjusted basis, we felt much more comfortable with this exposure.

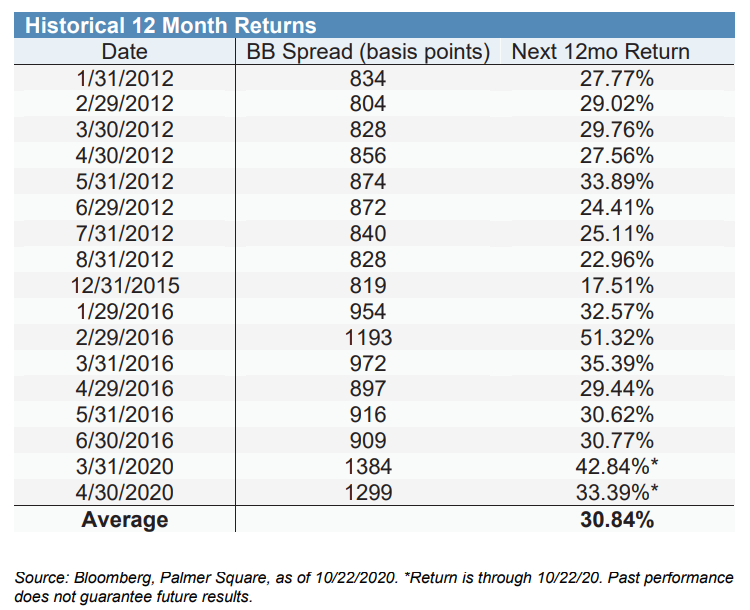

As we often state in these updates, we are not primarily thematic investors but we do try to be aware of the headwinds and tailwinds that we glean from the hundreds of manager calls and meetings that our Research Team performs in a given year. With that backdrop in mind, as markets and economic activity continued to heal throughout the spring and summer months, we looked for areas that had remained dislocated despite the broader recovery in more liquid and plain vanilla credit and fixed income markets. Unsurprisingly, most of these opportunities were in sub-investment grade credit and, more specifically, in the structured credit markets which continued to be penalized for being less liquid, and in many cases, for being more complex. We continue to see less liquid market sectors offer compelling return potential while their more liquid counterparts have traded back to pre-Covid levels. By way of example, below we try to demonstrate the historical return opportunity when BB-rated CLO debt trades at high credit spread levels.

Away from credit and fixed income markets, the primary story of the balance of 2020 will likely be the sector rotation that has been slowly manifesting as we approached the Presidential election (and that is certainly accelerating in the few days post that event). While it is, of course, not uncommon for markets to reposition around such an event as new policy implications can have a material impact, this rotation must also contend with the impact of the Covid-19 pandemic. While equity market sector/factor rotations are a consistent part of the investment landscape (and some would say increasingly so in recent years given the proliferation of and scale in factor-neutral hedge funds), the economic and societal backdrop could make the next few months much more notable/volatile even compared to some of the most recent market rotations. The dynamic between growth/momentum and value will almost certainly be something we’ll be writing about in our next update to clients.

While we continue to attempt to navigate what is a highly fluid global health, economic, and public policy landscape, we will continue to view the world along the same intellectual lines as we lay out above. We will try to remain cognizant of these very large and powerful macro forces as we look to understand the risks and sources of opportunity within client portfolios. We will also use some of that data to inform where we choose to dig the deepest within our universe of strategies that we can underwrite effectively. We are looking forward to putting 2020 in the books in several weeks, grateful to have survived such a volatile year with likely fewer than our fair share of investment fires to extinguish. While there is of course no way to know what next year will bring, we are certainly hopeful that it may be less eventful from a macro perspective.

*All Chart Sources: Bloomberg

Highlighted Research Process & Investment Opportunity

Something we like to stress in these updates is that, despite the always dynamic macro environment, the vast majority of the work that our Research Team does on a day-to-day basis is highly bottom-up in nature. As an intentional feature of our process, we look to spend most of our time in the weeds on individual managers and strategies, attempting to develop a qualitative understand of their investment strategy and process. We focus on this work because we believe we are fundamentally better at this idiosyncratic underwriting and that, over long periods of time, we will add more value for our clients by sourcing teams with well defined processes in their areas of expertise as opposed to trying to guess which economic trends will force large scale rotations of capital that drive Beta cycles across factors, strategies, asset classes, and sectors. All of this work can be summed into the investment cliché of trying to find managers with a sustainable edge and defensible competitive advantage over peers. Unsurprisingly, our best investment performance often comes from managers that not only have impressive pedigrees, teams, historical results, well-defined work flows and risk management frameworks, but also with firms that focus on a less scalable niche within a sub-sector of a market. That generic characterization applies across strategy buckets but may be most prevalent in Real Estate.

Vivaldi invests across the full spectrum of Real Estate, from mortgage credit markets on the more liquid end of the spectrum to ground-up development on the highest risk/least liquid end (and everything in-between). We view that spectrum in the context of risk and illiquidity as we do with any other strategy that we look to underwrite. To fold in some of our top-down awareness, a common refrain from market pundits in recent years has been how “overheated” the multi-family market is. To us, that viewpoint has always resonated as a partial truth most applicable to class A multi-family development in major metro areas. One thing that is always true about real estate generalizations is that they fail to capture the uniquely regional, sub-market, and even census track or asset-specific realities that actually drive the fundamental value of a real estate asset. As such, over the last few years, we have continued to evaluate many multi-family development strategies/funds that have come across our desk. Consistent with our work in any sector, the vast majority of those potential managers were a pass for us for one reason or another. With that said, in the second half of 2018 we found a team that was focused on a niche that we thought was defensible and with a process/approach that we believed was both impressive and highly repeatable. We ultimately became an anchor investor in that firm’s Fund I (consistent with our recurrent focus on early stage and more nimble managers).

That same team is now raising a Fund II within the same strategy vertical where we again intend to be a material investor. Specifically, this group develops multi-family housing in targeted high growth, strong demographic markets in the Southeast. In addition, they are developing what we believe is very high quality product intended to meet the high demand for “workforce housing” rental apartments. The view that this workforce housing is more defensible from economic contractions is not a unique one to Vivaldi, but we do believe the team we found is uniquely positioned to compete within the space. The group we discovered is no stranger to multi-family development, with a multi-generational footprint as it pertains to the group’s fully integrated General Contractor business unit. In addition, the build-out of the asset underwriting, finance, and asset management teams truly impressed us relative to the firm’s fairly modest size/scale. The highly repeatable nature of their development plans also offered this team several economies of scale in the actual execution of their ground up developments. All of these attributes combined, we believed, should allow the team to deliver a higher quality, brand new, workforce housing asset to the market at or below prevailing market rents for 20-30 year old competitive product. Our qualitative underwriting work on the team also gave us the belief that we were taking the bare minimum of duration/execution risk on the development timelines themselves (the highest risk period of any ground-up project). All that to say, our bet was very bottom-up in nature as opposed to a top-down call on the state of multi-family housing markets in the Southeast.

So how has that strategy been working out given the rapid fall into an employment recession and the challenge of a global pandemic? The honest answer is that it is too early to tell for sure as we continue to work through the development pipeline of Fund I, but it is instructive to consider a few key datapoints that drove us to “re-up” for Fund II. First, the team has continued to progress at or ahead of schedule relative to their own base case timeline at each asset that has broken ground. Despite material cost inflation pressures, particularly in the lumber market, they have continued to deliver projects at or below budget. In addition, they have continued to materially outperform lease-up timelines on the first assets they have completed even as those projects have been delivered into the teeth of the Covid-19 recession. Those lease-ups are also being completed at rental rates that are in excess of the team’s base case underwriting. Finally, they have continued to have advantaged access to debt financing even as less buttoned-up mom and pop competitors in these sub-markets have been closed out entirely from financing options.

All of those positive notes have translated into the first asset in this focused strategy being recently refinanced (post-Covid) by Fannie Mae, which allowed the operator to pull out greater than 80% of the equity in that development. That refinancing implies a roughly 39.7% gross IRR and 2.08x gross MOIC on this first asset, without any benefit to the cap rate compression likely available on a full sale of the property as well as any asset management alpha the team can create as they attempt to push rents at the now stabilized property. This impressive result has been generated on effectively a one-year timeline from groundbreaking to successful refinancing.

We highlight this team/strategy not to celebrate performance (as noted above, we are a long way from knowing exactly how this investment will pan out net-net) but instead to note the way we approach our work from a bottom-up perspective first. We think our focus on conservatism and attempting to align ourselves with high quality teams focused on less scalable niches is the best way to insulate ourselves from true risk of principal impairment regardless of the overarching macro backdrop.

Organizational Update

We are happy to report that we do not have many updates on the operational front. Like most organizations, we continue to be in a largely work remote environment. We have been very pleased with how well all of the functional units at Vivaldi have performed given this unprecedented challenge, particularly given the enduring timeline over which they have been asked to adapt to it. While everyone is missing the social interaction of the office, we have taken the opportunity to see each other in small groups, socially distanced, in outdoor settings while the weather has permitted. We are proud of the hard work the Vivaldi team has continued to perform in the service of our clients.

As we often note, we are continuously focused on expanding our firm resources and personnel in advance of the continued successful growth of our firm. From the Research Team desk, we are very pleased to announce the addition of Madeline Schneck to our analyst team. Madeline joined us this summer directly from her undergraduate studies at the University of Dayton. We have been impressed with Madeline’s work ethic, intellectual curiosity, and commitment (particularly given that she obviously started in a work-from-home mode). We’re excited for Madeline to continue to expand the bandwidth of our Research Team and welcome her to the firm.

As always, we want to thank you for your trust and confidence in Vivaldi. We are continuing to work every day to maintain that confidence. Please do not hesitate to reach out with any questions, comments, or client service needs.

Kind Regards,

Michael Peck, CFA

President, Co-Chief Investment Officer

mpeck@vivaldicap.com

Brian R. Murphy

Portfolio Manager

bmurphy@vivaldicap.com

To download a copy of this report, click here.