Market Perspective

As we eclipse the one-year anniversary of the “work from home” mandate, it is important to preface our commentary about financial markets and the broader investment landscape with the acknowledgement that we continue to do our work against the backdrop of a global health crisis. As has been the case since the onset of the COVID-19 pandemic, we continue to hope that our clients and their families are in good health. As the usual fits-and-starts of Spring commence here at Vivaldi’s headquarters in Chicago, we look forward with the hope that everyone’s life can begin to proximate something more “normal” in the quarters to come.

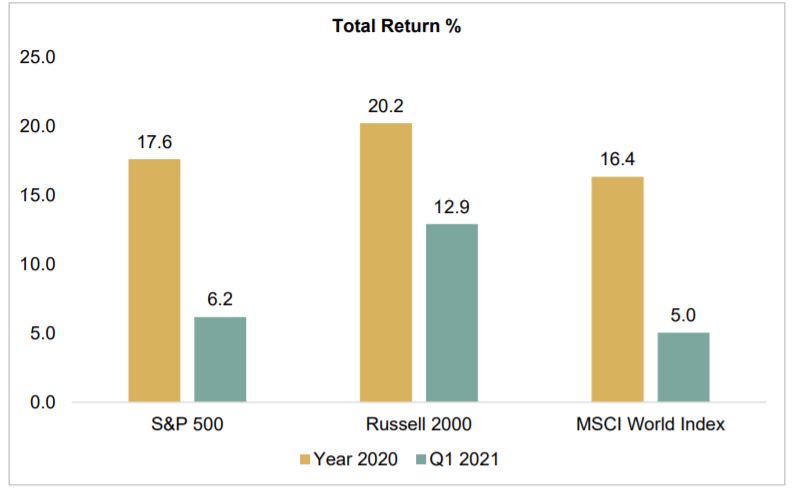

On the investment front, domestic markets continue to digest the impacts of new stimulus spending, wide-ranging proposed changes to tax policy, the initial implications of a reopening wave, and the ongoing impact of the global health crisis on all areas of the economy. The first quarter of 2021 was a rather positive one for domestic equity markets, which extended their rally after a very strong close to 2020. The persistence of the equity market rally in recent quarters has undoubtedly benefited from the unprecedented stimulus spending, as well as historically low interest rates, the latter of which is particularly important for the value of long duration equity securities.

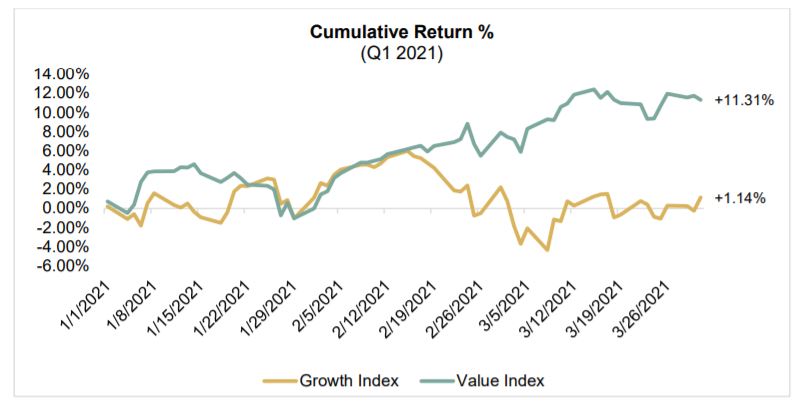

As is generally the case, the underlying rotations and themes that generated these strong market gains were more nuanced. The most notable shift occurring around the middle of the first quarter was the sudden and significant factor rotation from growth to value. This was particularly impactful because the outperformance of growth had reigned for several years on an order of magnitude that was historically rather large.

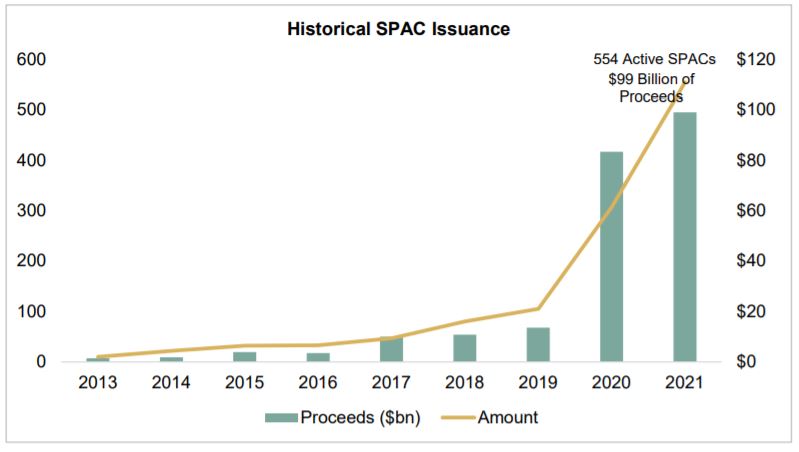

Another notable theme was just how open the capital markets window has been even in the midst of an uncertain global macroeconomic backdrop. Whether one looks at the Special Purpose Acquisition Vehicle (“SPAC”) market, the positive reception for the most recent wave of massive technology IPOs, or the record amount of issuance in certain debt sectors, it is clear that the capital markets are currently running like a well oiled machine. Even as some of the speculative froth has retreated from some certain areas (like SPACs), the overall level of activity even in those sub-sectors has been impressive in any historical context. While such accomodative equity and debt capital markets can conceal true fundamental weakness, many companies within those markets have continued to report near record-setting fundamental performance as well.

One undeniable upside of such accommodating capital markets is that, thus far, the financial ecosystem has been able to absorb and contain several negative market events without those risks spilling over into tangential markets. In our last two letters we discussed both the forced liquidation within the mortgage REIT sector (and some related areas) in the middle of 2020, as well as the massive hedge fund unwind that occurred in January of 2021. More recently, headlines were dominated by the losses taken by a handful of investment banks when a highly leveraged family office client was forced to meet large margin calls. Our concern around these types of market events usually has to do with the unexpected ways that forced liquidation and deleveraging in even a small sub-sector of the financial markets can be contagious to larger and more systemically important market functions. While all of the events we just discussed have been very impactful to a sub-set of market participants, the reality is none of them have yet produced material correlated risks elsewhere in financial markets.

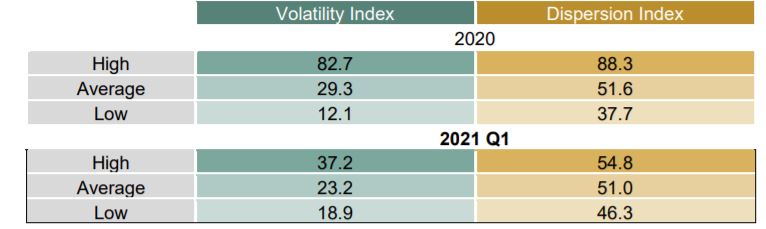

As discussed in our last letter, one of the most notable themes in equity markets in recent quarters has been the continued and significant dispersion across both sectors and individual securities as the relative winners and losers of COVID-19 became clearer. That trend has continued in 2021, with the additional tailwind that we have seen volatility across the market compress notably

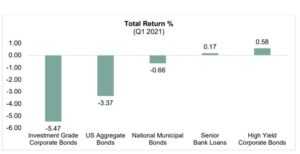

Lastly, it is worth noting that credit markets ranging from US Treasuries to more nuanced structured credit have all recovered from their COVID-19 dislocation in truly impressive form. While the first quarter of the year was somewhat of a muted period for broad credit market performance (as seen in the chart below), much of the weakness was due to interest rate duration sensitivity as rates backed up modestly or to broader trading pressure on secondary markets from record or near-record new debt issuance. While the wave of corporate defaults in both high yield and leveraged loans in 2020 was certainly material in a historical context, it appears that the peak of those defaults is now behind us. While the stressed and distressed credit hunting grounds remain fruitful, the average healthy company has very easy access to inexpensive credit markets. We continue to see the same positive operating environment persist in the structured credit markets. Global institutions, driven by continued low and negative international interest rates, have been very aggressive on the yield they are looking for on very high-rated bonds backed by these securitizations. That continued demand has been responsible for driving a huge boom in issuance of securitized product.

As always, we want to be candid about our limited ability to successfully make overarching macro calls. Our team spends a lot of time talking to market participants of all shapes and sizes and we look to aggregate insights from those dialogues to help inform where we choose to focus our attention from both a prospecting and risk management/oversight perspective. As we roll toward the summer, we continue to be impressed (if not outright surprised) at how well broader financial markets are coping with the continued backdrop of a global health pandemic. With that said, we will always have a focus on attempting to remain vigilant with respect to emerging risks that could affect any of our underlying managers or strategies.

*All Chart Sources: Bloomberg

** Historical SPAC Issuance Chart Source: Citadel Securities

Highlighted Research Process

Over the last seven years, our research team is proud of the work that has been done and our primary focus on the sourcing, diligence, and oversight of high quality investment opportunities for the benefit of our broader firm platform. We have always been cognizant of the dedication and discipline that is required in remaining intellectually curious enough to always look for the next strategy or opportunity set niche while also holding ourselves accountable to trying to source bestin-class opportunities, rather than to an additional strategy just for the sake of “filling a bucket”. We have always tried to approach the fundamental investment sourcing work from a proprietary investment mindset, compared to many of our peers who are more incentivized to add a plethora of options to have some investment solution for any possible strategy that a client could ever ask for. This commitment also shows up in our desire to source the best manager we can find within a given strategy or sub-sector, as opposed to having multiple firms that all traffic in the same area and which tends to result in more “industry average” exposure.

Our research team talks a lot about potential overlap between managers and strategies. We try to be efficient about investing our time and energy in attempting to source new opportunities that add material diversification relative to our existing manager line-up. We also do this from the lens that we genuinely believe that there are only certain strategies that we can effectively and responsibly underwrite and monitor from a fundamental perspective at any given time. All that is to say that we attempt to keep the bar high for adding a manager to our line-up.

Coming into last year, our research team sat down to attempt to identify either gaps within our existing investment line-up, or areas of new opportunity where we thought a more focused effort

could yield a great addition to our footprint. We spend much more time focused on the day-to-day bottom up work of talking to as many teams and managers as we can, but we do find some value in occasionally stepping back and having this more top-down conversation. One area that we highlighted for focus was expanding our geographic reach by sourcing more Asian and Europeanbased opportunities. Our research team has extensive historical experience investing outside of North America, but our work over the last several years at Vivaldi has been much more focused on the domestic opportunity set at least from a team location perspective. The reason for that domestic focus is simple: to responsibly cover the opportunity set in Europe and Asia, you have to be willing to physically be there with some degree of regularity. We’re big believers in the value of meeting teams in person and the benefits of building a network through industry gatherings in the local market in which the actual investment opportunity exists. One outcome of this more thematic top-down team discussion was that we thought there was a decent amount of value that could be added to our overall manager and strategy line-up by finding internationally-based teams focused on opportunity sets to which our existing manager footprint would give us only marginal exposure.

Despite the difficulties presented by COVID-19, particularly around travel restrictions, we were able to onboard our first European headquartered manager in calendar year 2020. We are also happy to report that it is highly likely that we will formally approve our first Asia-focused strategy later this quarter. While that build out has been slower than we would have hoped, we are happy with our team’s dedication and creativity in getting through our full diligence process (including sitting with key principals of these firms in person) in the midst of COVID-19 travel restrictions. As the ability to move around the globe continues to improve, we hope to have even more news to report on this front, as we continue to believe that making a real effort to underwrite ex-U.S. strategies will prove accretive to our clients from opportunity set and diversification perspectives.

For anyone who may be interested in what our team is seeing in our international research efforts, or any other sector for that matter, never hesitate to reach out.

Organizational Update

As we often note, we are continuously focused on expanding our firm resources and personnel in advance of the continued successful growth of our firm. In Q1, the firm made several additions across our operations, client service, and advisory support teams. Vivaldi remains chiefly committed to ensuring that we grow our human capital in advance of our overall firm growth in order to continue to deliver a highly personalized experience to our clients.

In addition, some of you may have seen the announcement of our newest advisor, Frank Pellicori, who joined us towards the end of March. Prior to joining Vivaldi, Frank had been with UBS for roughly 10 years where he served as a senior vice president of a three-advisor team with roughly $2 billion assets under management, specializing in high net worth and family office clients. We are excited for the new ideas and opportunities that come with having Frank on our team and look forward to working with him to continue servicing our clients.

As always, we want to thank you for your trust and confidence in Vivaldi. We are continuing to work every day to maintain that confidence. Please do not hesitate to reach out with any questions, comments, or client service needs.

Kind Regards,

Michael Peck, CFA

President, Co-Chief Investment Officer

mpeck@vivaldicap.com

Brian R. Murphy

Portfolio Manager

bmurphy@vivaldicap.com

THIS LETTER IS INTENDED FOR THE USE OF THE RECIPIENT ONLY, AND MAY NOT BE REPRODUCED OR DISTRIBUTED TO ANY OTHER PERSON, IN WHOLE OR IN PART, WITHOUT THE PRIOR WRITTEN CONSENT OF VIVALDI CAPITAL MANAGEMENT, LP (“VIVALDI”). THIS IS NOT AN OFFERING OR THE SOLICITATION OF AN OFFER TO PURCHASE AN INTEREST IN ANY SECURITY OR TO INVEST IN ANY FUND OR ACCOUNT ADVISED OR RECOMMENDED BY VIVALDI. ANY SUCH OFFER OR SOLICITATION WILL BE MADE ONLY TO QUALIFIED INVESTORS BY MEANS OF A CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM (THE “MEMORANDUM”) OR SIMILAR FORMAL DOCUMENTATION AND ONLY IN THOSE JURISDICTIONS WHERE PERMITTED BY LAW.

NO ASSURANCE CAN BE GIVEN THAT A FUND’S INVESTMENT OBJECTIVE WILL BE ACHIEVED OR THAT AN INVESTOR WILL RECEIVE A RETURN OF ALL OR PART OF HIS OR HER INVESTMENT. ANY DESCRIPTIONS INVOLVING INVESTMENT PROCESS, INVESTMENT EXAMPLES, STATISTICAL ANALYSIS, INVESTMENT STRATEGIES OR RISK MANAGEMENT TECHNIQUES ARE PROVIDED FOR ILLUSTRATION PURPOSES ONLY, WILL NOT APPLY IN ALL SITUATIONS, MAY NOT BE FULLY INDICATIVE OF ANY PRESENT OR FUTURE INVESTMENTS, MAY BE CHANGED IN THE DISCRETION OF VIVALDI AND ARE NOT INTENDED TO REFLECT PERFORMANCE.

INVESTING IN ALTERNATIVE INVESTMENT STRATEGIES, SUCH AS HEDGE FUNDS AND PRIVATE EQUITY FUNDS, MAY ENTAIL SUBSTANTIAL RISK AND MAY NOT BE SUITABLE FOR ALL INVESTORS. MANY ALTERNATIVE INVESTMENT MANAGERS AND THEIR RELATED PRODUCTS ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MORE TRADITIONAL INVESTMENTS, SUCH AS MUTUAL FUNDS. ALTERNATIVE INVESTMENTS MAY INCLUDE SPECIFIC RISKS ASSOCIATED WITH LIMITED LIQUIDITY, USE OF LEVERAGE, ARBITRAGE, SHORT SALES, OPTIONS, FUTURES, AND DERIVATIVE INSTRUMENTS. THERE CAN BE NO ASSURANCES THAT A MANAGER’S STRATEGY (HEDGED OR OTHERWISE) WILL BE SUCCESSFUL OR THAT A MANAGER WILL EMPLOY SUCH STRATEGIES WITH RESPECT TO ALL OR ANY PORTION OF A PORTFOLIO.

UNLESS OTHERWISE INDICATED, ANY PERFORMANCE SHOWN IS UNAUDITED, NET OF APPLICABLE OPERATING, MANAGEMENT, PERFORMANCE, AND OTHER FEES AND EXPENSES, PRESUMES REINVESTMENT OF EARNINGS AND EXCLUDES INVESTOR SPECIFIC SALES AND OTHER CHARGES. PLEASE REFER TO A FUND’S MEMORANDUM FOR MORE INFORMATION REGARDING THE FUND’S FEES, CHARGES, AND EXPENSES, WHICH WILL REDUCE THE FUND’S GAINS. PERFORMANCE MAY VARY SUBSTANTIALLY FROM YEAR TO YEAR OR EVEN FROM MONTH TO MONTH. AN INVESTOR’S ACTUAL PERFORMANCE AND ACTUAL FEES MAY DIFFER FROM THE PERFORMANCE INFORMATION SHOWN DUE TO, AMONG OTHER FACTORS, CAPITAL CONTRIBUTIONS, AND WITHDRAWALS/REDEMPTIONS. INVESTMENT RESULTS MAY VARY SUBSTANTIALLY OVER ANY GIVEN TIME PERIOD AND THE VALUE OF INVESTMENTS CAN GO DOWN AS WELL AS UP. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

ANY OPINIONS, ASSUMPTIONS, ASSESSMENTS, STATEMENTS OR THE LIKE (COLLECTIVELY, “STATEMENTS”) REGARDING FUTURE EVENTS OR WHICH ARE FORWARD-LOOKING, INCLUDING REGARDING PORTFOLIO CHARACTERISTICS AND LIMITS, CONSTITUTE ONLY SUBJECTIVE VIEWS, BELIEFS, OUTLOOKS, ESTIMATIONS OR INTENTIONS OF VIVALDI, SHOULD NOT BE RELIED ON, ARE SUBJECT TO CHANGE DUE TO A VARIETY OF FACTORS, INCLUDING FLUCTUATING MARKET CONDITIONS AND ECONOMIC FACTORS, AND INVOLVE INHERENT RISKS AND UNCERTAINTIES, BOTH GENERAL AND SPECIFIC, MANY OF WHICH CANNOT BE PREDICTED OR QUANTIFIED AND ARE BEYOND VIVALDI’S CONTROL. VIVALDI UNDERTAKES NO RESPONSIBILITY OR OBLIGATION TO REVISE OR UPDATE SUCH STATEMENTS.

CERTAIN INFORMATION CONTAINED IN THIS LETTER IS BASED ON INFORMATION OBTAINED FROM THIRD-PARTY SOURCES THAT VIVALDI CONSIDERS TO BE RELIABLE. HOWEVER, VIVALDI MAKES NO REPRESENTATION AS TO THE ACCURACY, FAIRNESS OR COMPLETENESS OF SUCH INFORMATION.