Market Perspective

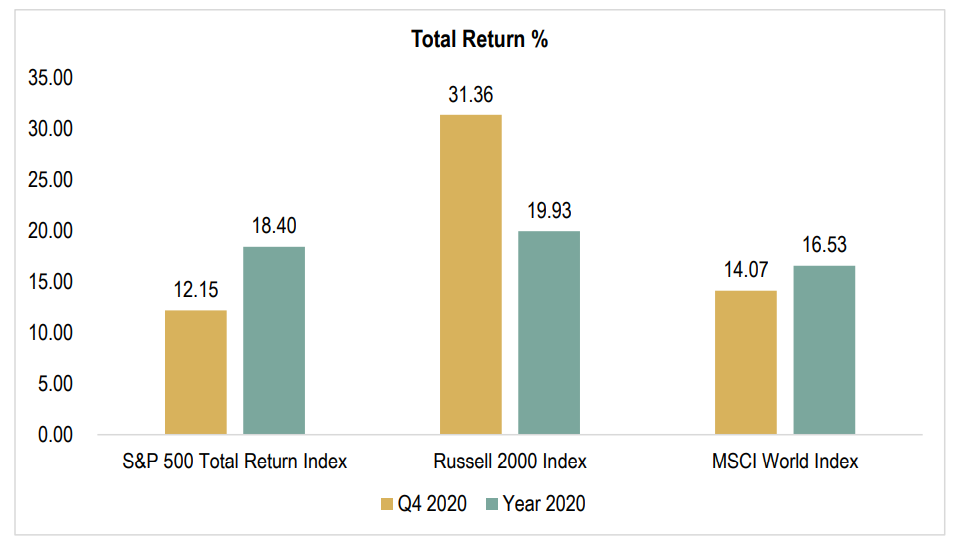

First and foremost, the Vivaldi team hopes that this correspondence finds you and your loved ones healthy this winter. As we continue to work on our clients’ behalf in assessing market developments and opportunity sets, we do so with the knowledge that we are very fortunate to have a professional ecosystem that has been largely adaptable to the ongoing public health crisis. As we now look back at the full calendar year of 2020 with the benefit of hindsight, we can see that it was a year that will be remembered for both its volatility as well as its remarkable strength and resiliency in the face of tectonic economic and social challenges. The fourth quarter provided the exclamation point for that assessment, as equity markets posted some of the strongest gains for a quarter ever (within certain indexes and markets), capping a year of impressive performance against an economic backdrop that few would have associated with positive returns across most asset classes but most notably equities.

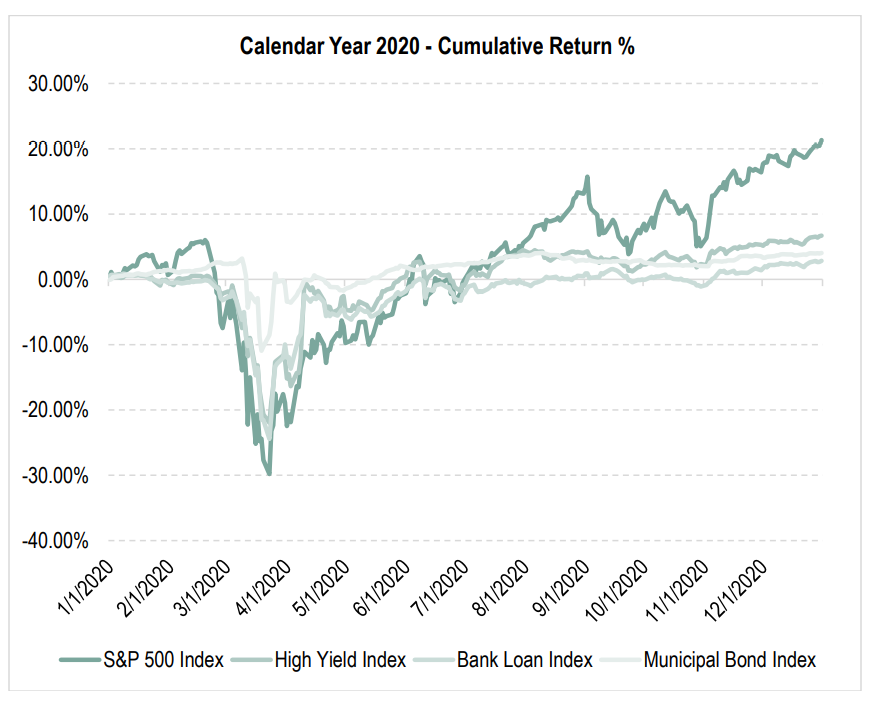

A theme that we have noted over the last several years in these letters around market drawdowns is the rapidity with which these corrections now transpire. The market dislocation in the March/April timeframe as the domestic reality of the Covid-19 outbreak became widely evident for the first time was both dramatic and swift. This was true within equity markets, but it proved

even more so true in credit markets, particularly less liquid credit markets. While equity markets were very quick to recover, several esoteric credit and structured credit markets remained much

more fertile areas of opportunity for most of 2020, including the fourth quarter. The tremendous and prompt recovery rally in equities ran well ahead of the credit recovery, counterintuitive to the

actual priority of claims within a company capital structure but logical in the sense of which markets are most liquid and easiest to “access” by non-institutional investors. Much has been written about the “Robinhood Effect” of retail investor participation in equities, particularly growth oriented technology and healthcare stocks. Those forces were front-and-center in many professional’s minds even before the prolific short squeezes. The very nature of how trading technology and market access has been democratized and brokerage/trading costs have been compressed has allowed anyone working from home to trade their accounts between Zoom calls with very little operational friction. The nexus of that ease of access and the reach of social media have combined to create the first ever mass market cornering of a relatively short list of highly shorted small capitalization stocks. One aspect of Vivaldi’s underwriting process has always been to assess how a manager’s portfolio construction and risk management philosophy accounts for hedge fund crowding and consensus versus counter-consensus risks. While the dust has yet to settle from the wild swings of recent trading days, we have not been directly exposed to any of the worst January monthly performance marks (20% – 80% drawdowns for some brand-name hedge funds) that have made their way around the press.

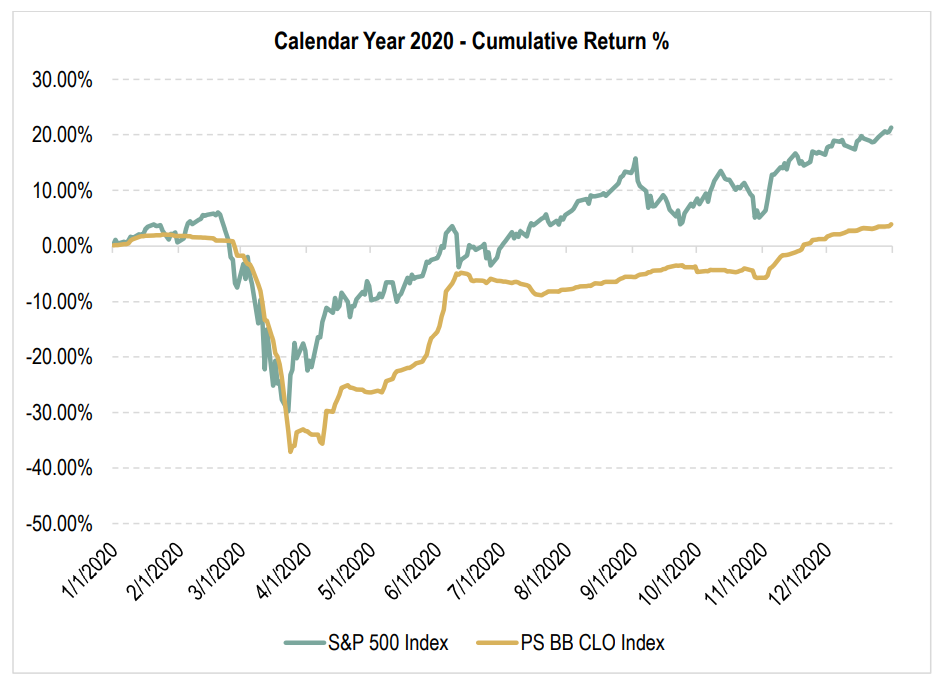

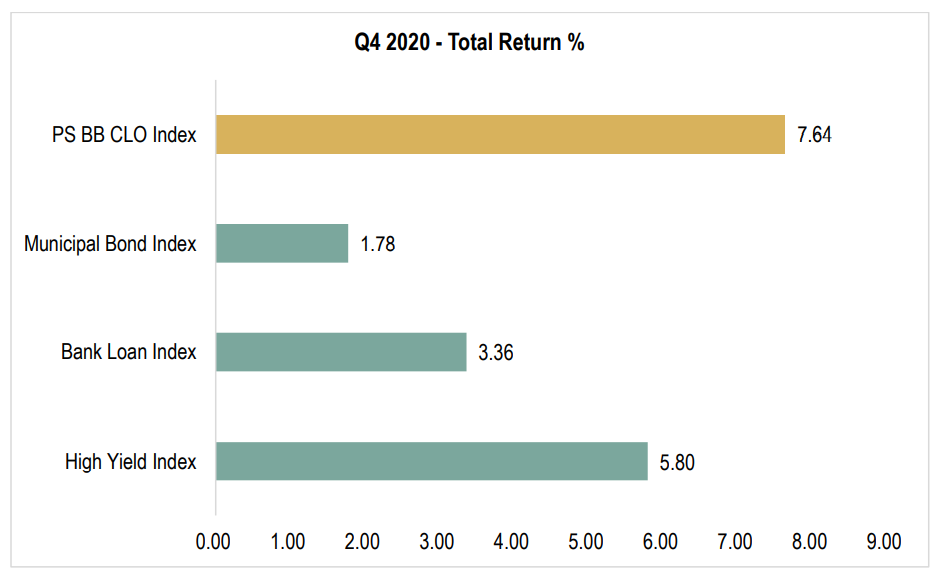

That market access in many sub-sectors of the credit market remains much less efficient. By way of example, in March our research team spent a considerable amount of time looking for a liquid

way to gain tactical exposure to the B and BB tranches of the CLO market. We scoured the ETF/mutual fund/traded closed-end-fund landscape to little avail. Ultimately, we were fortunate to

be able to increase our exposure through our preferred operating partner in the CLO space both via a custom program where we co-invest alongside them as well as through their quarterly liquidity interval fund. Those types of solutions are generally not structurally viable for the average individual investor. While that was only one factor in why credit markets were slower to recover

than equities, we do believe it is one worth highlighting because that difference in liquidity/accessibility, and subsequent market performance, will almost certainly persist in the near and intermediate term. Below we chart a few broader credit sectors against the recovery of the S&P 500 in 2020.

This lag in recovery was even more pronounced in the less liquid ends of credit markets where representative benchmarks are harder to come by.

With a tinge of reticence, we acknowledge that the full year 2020 actually ended up being a rather strong period for most markets, asset classes, and strategies. This was particularly true in the

alternative investing space where, while absolute returns may have lagged behind red hot equity benchmarks, risk-adjusted or market-exposure-adjusted returns were as healthy as they have

been in several years. For some strategies, these strong results owed themselves to managers opportunistically taking advantage of the market dislocation in the early part of the year. For many

more strategies, this risk-adjusted outperformance was the byproduct of sustained market volatility and increased return dispersion across asset classes, sectors, and securities. Outside

of firms that simply got a lot of fundamental work dead-wrong during the year, the only cohort of industry participants that had a truly difficult year was the small subset of strategies that came

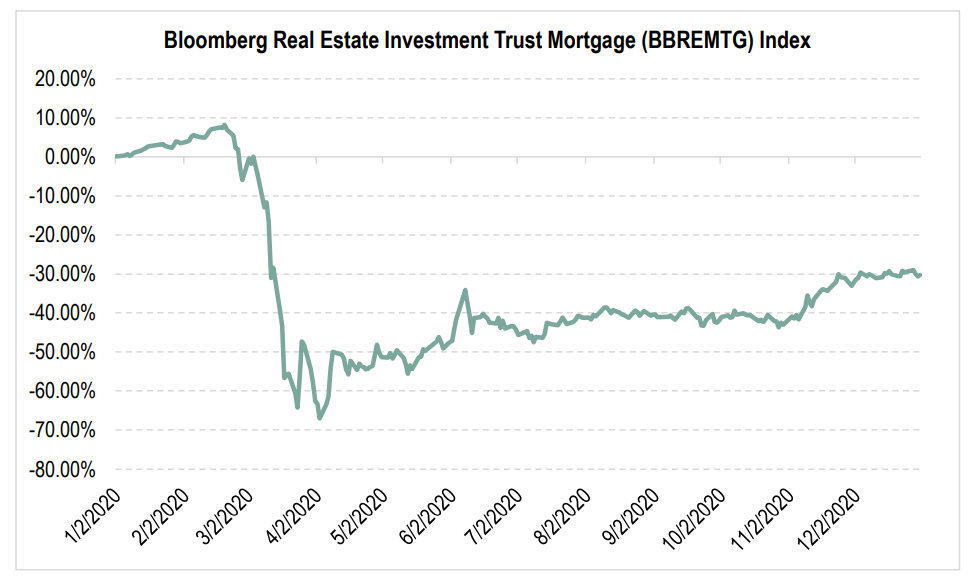

into the March/April period with a high degree of leverage and poor asset-liability mismatches on that financing. One area that exemplified this plight was the mortgage REIT market. These

vehicles typically run with high structural and financial leverage and own the type of less liquid credit securities that were most out of favor in the market dislocation. It was those securities that

saw the most pronounced evaporation of liquidity during the initial market correction and ensuing months. As investors redeemed from those strategies, the underlying funds were forced to sell

assets at depressed prices to both meet those redemptions and to pay down leverage. To put the magnitude of the de-leveraging in that sector and its impact on the performance of those

strategies in context, below is a chart of the Bloomberg Mortgage REIT Index. We would note that the fundamental realized credit losses in the mortgage space in 2020 have been minimal, as residential housing has remained remarkably strong. This chart is a great example of why Vivaldi focuses on asset-liability risk fanatically across all of our investments.

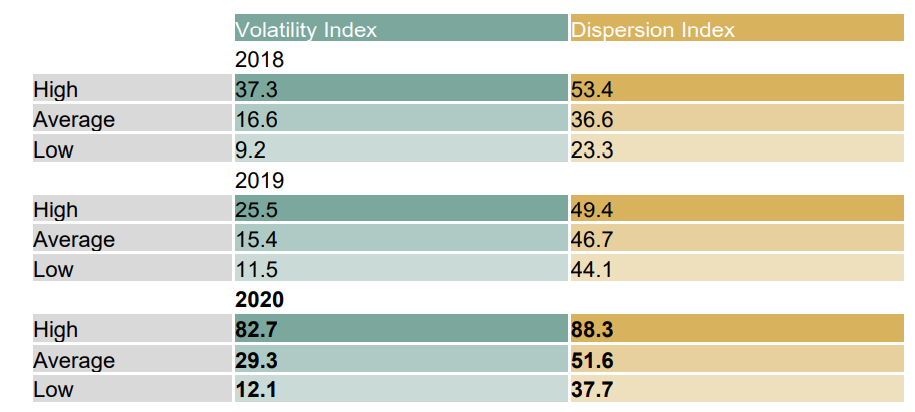

As discussed above, one of the most notable themes in equity markets in 2020 was the continued and significant dispersion across both sectors and individual securities as the relative winners

and losers of Covid-19 became clearer. Below is a quick snapshot of equity market volatility and dispersion in 2020 compared to the two prior years. The persistent uncertainty and evolving

economic picture produced by the Covid-19 pandemic and other macro issues resulted in a rare period of consistently elevated but relatively moderate volatility and dispersion.

It is almost easy to forget that 2020 saw one of the largest waves of corporate credit defaults in history. On a pure dollar basis, those aggregate defaults (for corporate credit) eclipsed the totals seen in the nadir of the 2008/9 global financial crisis. While some of lowest balance sheet quality cyclical businesses with Covid-19 sensitivity were formally pushed into bankruptcy (primary in the energy, industrials, and over-leveraged consumer/retail sectors), the overall health of the corporate credit market improved rapidly throughout the year. The fourth quarter saw a continued

rally in most broad-based fixed income and credit markets, but the largest gains were in more esoteric credit sectors which did not benefit directly from the massive infusion of liquidity at the hands of the Federal Reserve bank earlier in the year.

From an outlook perspective, many market participants will continue to be focused on the returns of headline-grabbing technology equities, or the newly red hot IPO market for several of the

“unicorns” that have been the darlings of venture capital and private equity over the last decade. While those headlines are always fun and do have indirect (and sometimes direct) implications

for our private equity and venture capital investments, our research team is more focused on monitoring the health and recovery path of credit markets and keeping an eye on the trillion dollar

risks associated with the rates markets. These latter areas are particularly in flux given the prevailing consensus that more fiscal stimulus is just around the corner and that the ultimate

severity and duration of the Covid-19 pandemic, and its effect on already strained businesses, remains unknowable. As we always stress in these letters, while we are not macro investors, we

certainly understand that environments like today are inherently macro-dependent. In the meantime, we continue to try to source managers and strategies that have enough domain expertise to execute in even the most challenging of macro backdrops with the view that 2021 could, of course, be less hospitable to markets than 2020 ended up being.

*All Chart Sources: Bloomberg

Highlighted Research Process

If someone had told our Research Team back in March that 2020 would end up being one of our most active years from an Investment Committee perspective, we certainly would have been

skeptical. The reality is, after getting through the initial triaging of our existing roster of managers and investments and finding fewer than expected fires to put out, we quickly pivoted to focus

much of our attention on areas of opportunity to dig in on. A question that we have received frequently in recent quarters is how our team has augmented our investment and operational due

diligence work amidst a pandemic? The answer is nuanced depending on the nature of the strategy and/or investment, so we wanted to provide some additional context here.

Above all, we should acknowledge that our 2020 investing pipeline benefited from all of the work our team has done in previous years to align ourselves with what we clearly believe are best in

class operators within their respective sector or strategy. This meant that we entered 2020 with a very healthy balance of investments across our platform/portfolios, as our team is always working

to identify “gaps” where we think we would benefit from having a particular strategy or operating expertise represented across that platform. As noted in the market review section of this letter,

anecdotally, that meant that when we believed that the liquidity-driven dislocation in more junior B/BB rated CLO tranches was particularly unwarranted, we could pick up the phone and call our

operator in that area and benefit from their expertise in a very narrow window of time. The groundwork we did in recent years to constantly be vigilant about the breadth and quality of our

investment options certainly benefited us in a difficult operating environment for sourcing, diligence, and approving new investments. This was especially true in our less liquid investing in

private equity, real estate, and illiquid credit. With the help of a little serendipity, we ended up having several existing managers in whom we have built incredible confidence come to market

for their next vintage fund, allowing us to deploy new dollars with existing teams in the midst of a more attractive opportunity set than some of them had seen in several years.

Beyond the benefit of that legacy effort, however, we also made a handful of new additions to our management/investment line-up when we found opportunities that we thought were sufficiently

attractive and complementary to warrant an immediate diligence process, despite being in the midst of a pandemic. It is worth noting that we added new investments in every strategy vertical

that our team covers on the alternatives front: hedge funds, private equity, real estate, venture capital, and illiquid credit.

From an investment due diligence perspective, we, like the rest of the business world, had to rely more heavily on conference calls and video meetings. That process was often more iterative and

slower than it would have been if we could have paired these calls with our more exhaustive onsite meetings, but that was a reality of this environment and we think we conquered it reasonably

well. The operational due diligence component of our work was even more interrupted by the inability (largely) to travel and sit with teams in a physical office environment. During our on-site

meetings, Nick Lotysz, our Head of Operational Due Diligence, will often view processes like employees physically logging into systems and accounts and seeing tangible examples of how

critical control environment procedures like cash transfers and valuation workflow actually happen. In addition, the ability for our research team to audible in on-site meetings and triangulate

the answers from various firm employees on the spot without other people on a call to help corroborate previous responses is much more challenging in a virtual format. In some instances,

our team determined that there really was no substitute for simply being on the ground to do some foundational analysis like site inspections for our real estate investments or to physically sit down with the key members of an investment team that we had not met with in person before to have some baseline qualitative assessment of their personalities at least as a benchmark for future interactions. Both our investment and operational processes dug in even deeper on professional reference checks for the key personnel of those new investments that were considered and

approved last year. The networking ability of our team proved beneficial yet again where we gained much greater comfort through triangulating our own references independently from those

an underlying manager may provide. We are incredibly proud of our team for being willing and able to do this work against a difficult backdrop.

While our team here at Vivaldi is no different than just about anyone else who is waiting for a more “normal” pre-Covid environment to begin to ebb back into our day-to-day work, we are proud

of the commitment we exhibited to finding ways to continue to complete our mandate. While we are all eager to get in line for a vaccine that may open up more travel, we are also realistic that

the current operating environment (or at least material aspects of it) is likely to be here for quite some time. In that vein, we remain doubly-committed to completing that work as exhaustively as ever regardless of circumstances that are outside of our control.

Organizational Update

As we often note, we are continuously focused on expanding our firm resources and personnel in advance of the continued successful growth of our firm. In Q4, Vivaldi acquired a new wealth

management team out of San Diego – Cornerstone Wealth Management. Cornerstone was founded in 1999 and brings approximately $200M of new assets to Vivaldi’s platform, including

their long-standing private fund which Vivaldi now manages. All Cornerstone team members as well as their office location can be found on our website – we look forward to long-standing

relationships with all of our new Cornerstone colleagues and clients. In addition to our firm-level acquisition, we made two new hires on the Vivaldi team, including Justin Clark who joined our

Client Service team from a large alternative investment custodian as well as Tom LaJeone, a Senior Trader who brings significant industry experience in the wealth management arena.

As always, we want to thank you for your trust and confidence in Vivaldi. We are continuing to work every day to maintain that confidence. Please do not hesitate to reach out with any questions, comments, or client service needs.

Kind Regards,

Michael Peck, CFA

President, Co-Chief Investment Officer

mpeck@vivaldicap.com

Brian R. Murphy

Portfolio Manager

bmurphy@vivaldicap.com

To download a copy of this report, click here.