Market Perspective

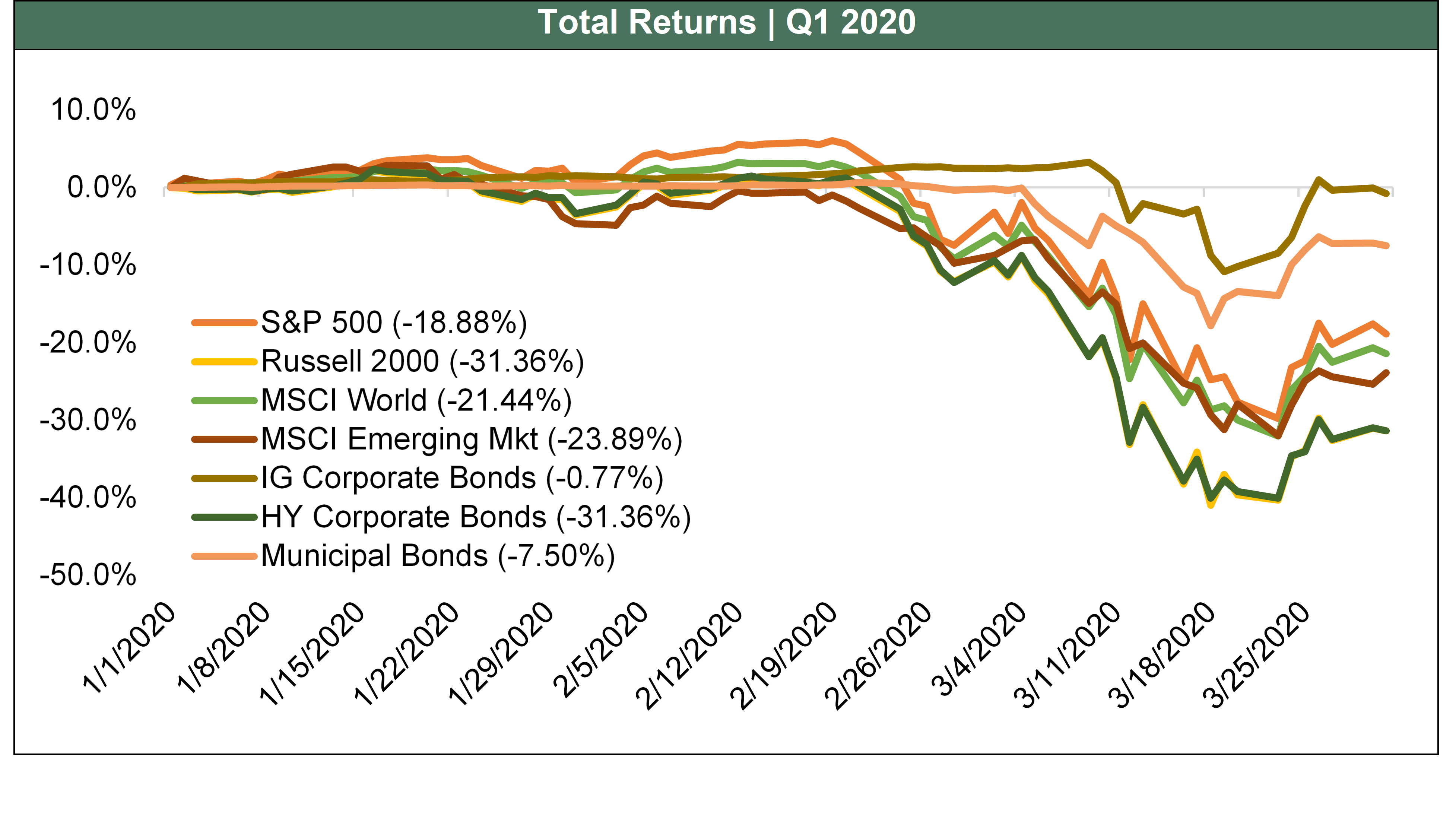

We would be remiss not to begin our usual quarterly correspondence by communicating the Vivaldi team’s sincere wishes for your good health and fortitude in the face of this global health crisis. This year will be one for the history books and likewise these market environments will be described alongside some of the biggest historical market corrections. The first quarter was an eventful one from an asset class and sector perspective. Without belaboring the various drawdowns, below is a select number of broad-based benchmarks.

Something the Vivaldi Investment Research team has been discussing a great deal internally (now on daily video conferences as opposed to in ad hoc conversations around our office) is the difficulty in extrapolating a useful analog to the current events in financial markets but also in the global economic system as a whole. While we would generally point to the collective historical experience of our team, which has witnessed several different market and economic contractions, it isn’t immediately evident that those prior events can be related to today’s range of risks that need to be taken into consideration. While the 1987 crash was epic in scale, it was relatively modest in duration and was largely a financial market event. In the subsequent 30 years, a non-exhaustive list — including the savings & loan crisis, dot-com bubble, 2001 recession, and the 2008 global credit contraction — have all had varying degrees of financial market versus real economic impact. Again, it isn’t perfectly clear to which of those prior events we should be looking to as the most akin to the current market and economic risks. The real economic, and direct societal impacts, of a health-related crisis are inherently harder to comprehend in the context of financial models and portfolio construction decisions, as the knock-on effects are, in our view, more numerous as well as more drastic in tail scenarios. Still, the team’s in-depth understanding of both fundamental and structural risks present within the broad set of financial markets has proven useful in ensuring that we are invested in a relatively protected position regardless of the cause, duration, and severity of economic distress.

Something the Vivaldi Investment Research team has been discussing a great deal internally (now on daily video conferences as opposed to in ad hoc conversations around our office) is the difficulty in extrapolating a useful analog to the current events in financial markets but also in the global economic system as a whole. While we would generally point to the collective historical experience of our team, which has witnessed several different market and economic contractions, it isn’t immediately evident that those prior events can be related to today’s range of risks that need to be taken into consideration. While the 1987 crash was epic in scale, it was relatively modest in duration and was largely a financial market event. In the subsequent 30 years, a non-exhaustive list — including the savings & loan crisis, dot-com bubble, 2001 recession, and the 2008 global credit contraction — have all had varying degrees of financial market versus real economic impact. Again, it isn’t perfectly clear to which of those prior events we should be looking to as the most akin to the current market and economic risks. The real economic, and direct societal impacts, of a health-related crisis are inherently harder to comprehend in the context of financial models and portfolio construction decisions, as the knock-on effects are, in our view, more numerous as well as more drastic in tail scenarios. Still, the team’s in-depth understanding of both fundamental and structural risks present within the broad set of financial markets has proven useful in ensuring that we are invested in a relatively protected position regardless of the cause, duration, and severity of economic distress.

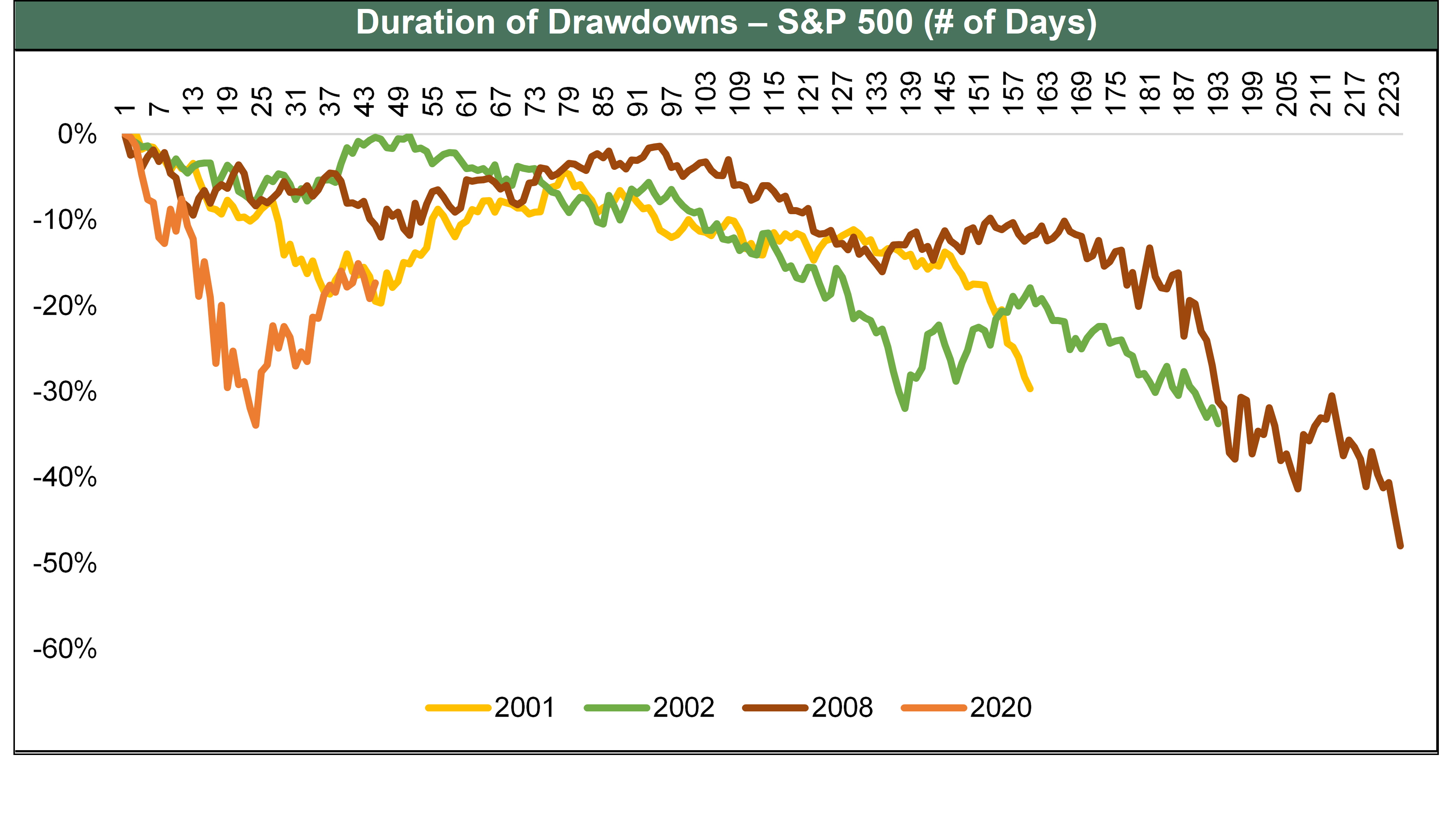

One easy way to view this very disparate set of market events is through the lens of broad-based domestic equities. Below is a chart of the peak-to-trough drawdowns of the S&P 500, measured as a function of time, for the last four bear market environments:

This simplistic view, to date, has portrayed a less than average level of concern around the COVID-19 period, as financial markets attempt to handicap the negative fundamental impacts of putting a global economy into an induced coma against their expectations for monetary and fiscal stimulus as well as a dizzying array of opinions as to how to forecast when that coma may come to at least a partial end.

This simplistic view, to date, has portrayed a less than average level of concern around the COVID-19 period, as financial markets attempt to handicap the negative fundamental impacts of putting a global economy into an induced coma against their expectations for monetary and fiscal stimulus as well as a dizzying array of opinions as to how to forecast when that coma may come to at least a partial end.

To spend a great deal of time in this note sharing our collective “best guess” of where our team’s consensus falls would almost certainly be a waste of your time, as we acknowledge that if our view ended up looking particularly prescient three months from now when we write our next letter that would owe itself to luck and serendipity more than our critical thinking skills. With that, we will highlight a few notable dislocations, bifurcations, and outright “strange stuff” that we have seen manifest in the current market environment.

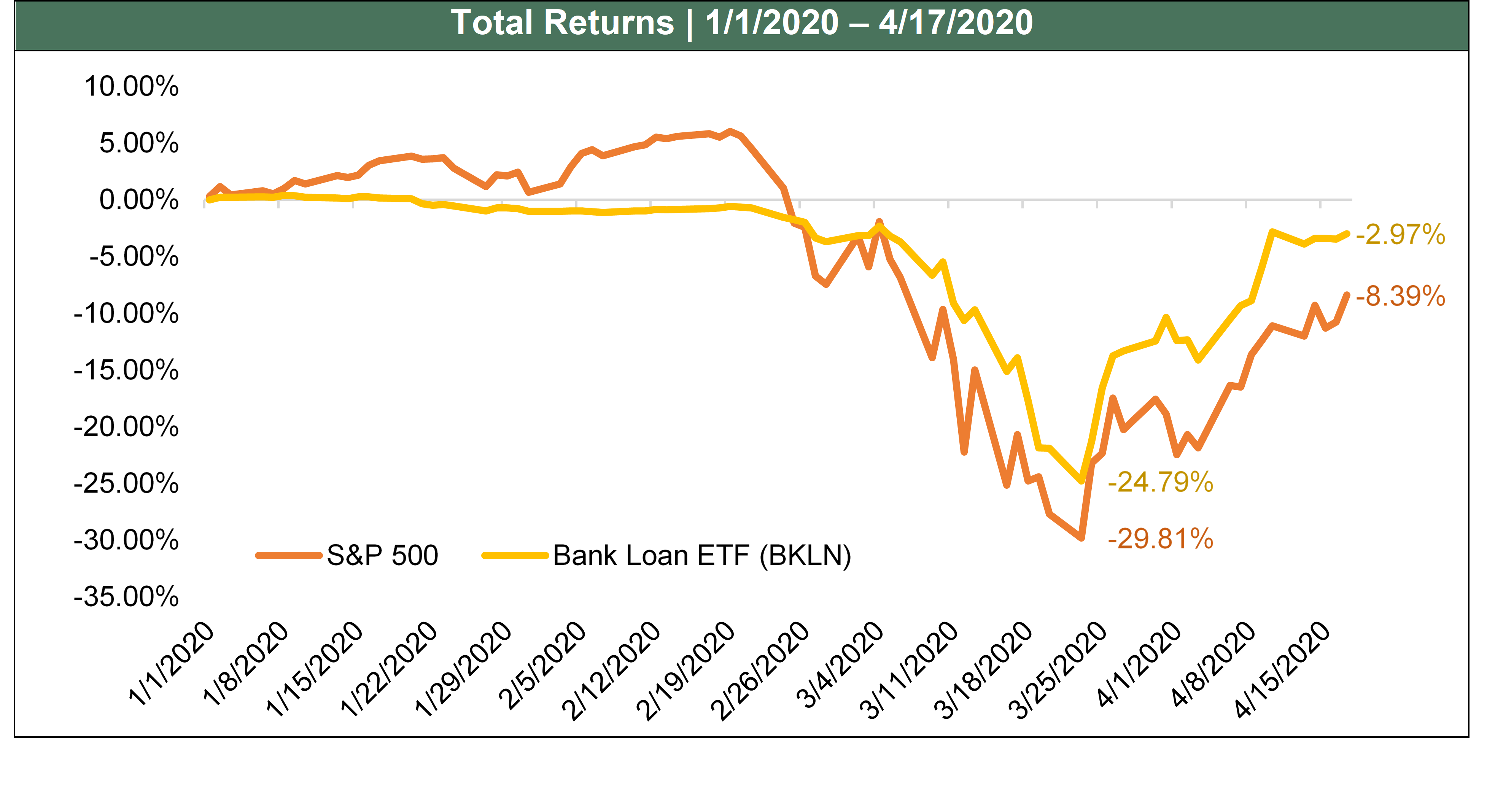

The first major theme that we have been focused on as a team is the broad underperformance of credit markets relative to equity markets. Whether looking to leveraged loans, high yield bonds, investment grade corporates, various sectors of structured credit, or even municipal bond markets, the broader relative risk construct when compared to more subordinated equities simply broke down. As a simple visual of this, we would point to the performance of the first lien leveraged loan market versus equities in advance of the Federal Reserve announcing the unprecedented action of buying outright longer-duration corporate credit on April 9th. The loans, which have clearly established protections and seniority over equity holders in bankruptcies, traded down nearly as much as the broader equity markets.

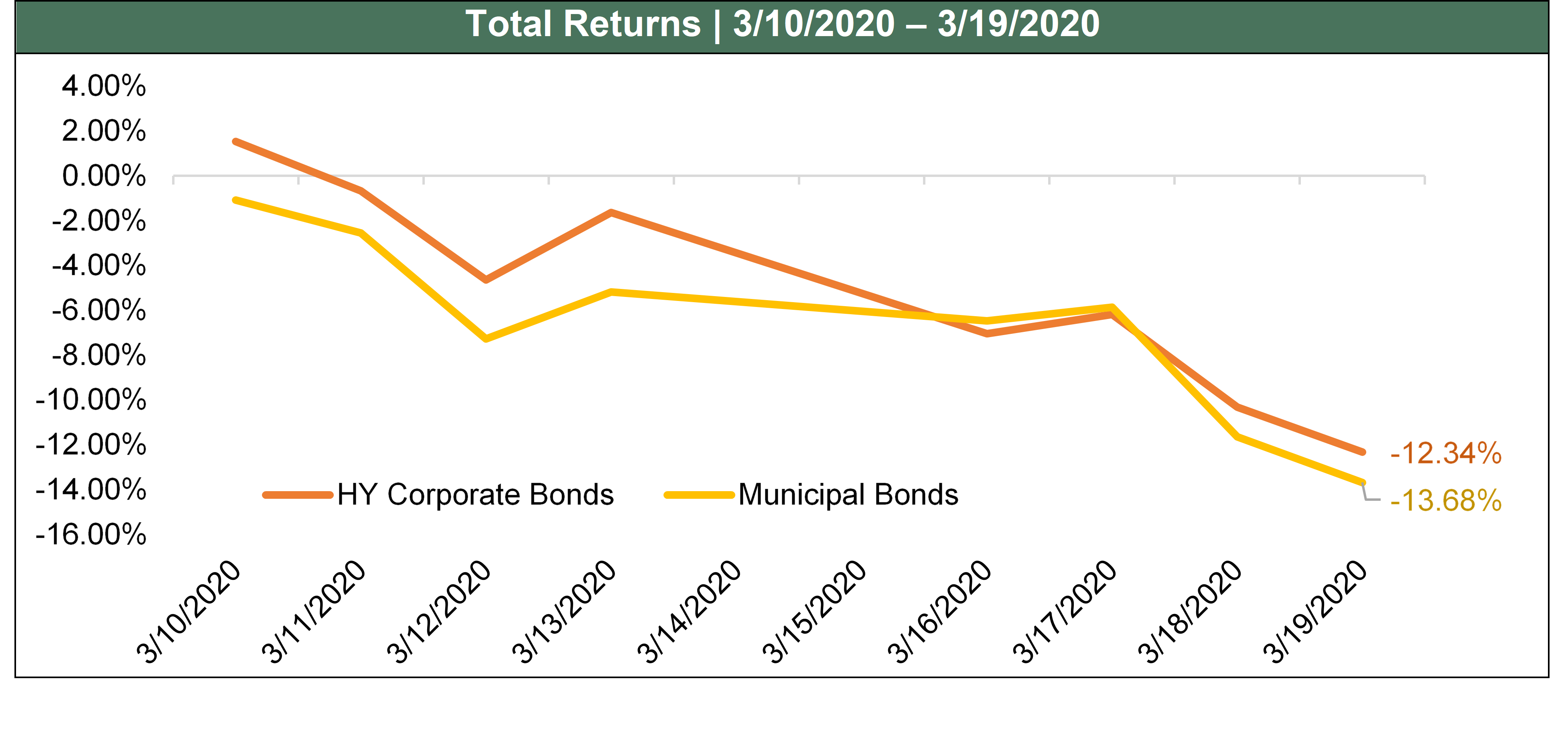

Similarly, we have also seen these types of risk paradigm dislocations across credit sub-sectors. Notably, certain areas of less liquid credit have materially underperformed more liquid credit that we would expect to actually carry more economic sensitivity. This was particularly pronounced, relative to our expectations, in municipal bond credit markets where junk bonds outperformed investment grade municipals for a period of time.

Similarly, we have also seen these types of risk paradigm dislocations across credit sub-sectors. Notably, certain areas of less liquid credit have materially underperformed more liquid credit that we would expect to actually carry more economic sensitivity. This was particularly pronounced, relative to our expectations, in municipal bond credit markets where junk bonds outperformed investment grade municipals for a period of time.

This was especially shocking as broader interest rates experienced a large risk-off rally (lower rates), which has historically provided a large tailwind for the duration-sensitive municipal sector. We saw similar dynamics between first lien loans and junk bonds within structured credit loan products (CLOs) even just relative to the very underlying loans themselves.

This was especially shocking as broader interest rates experienced a large risk-off rally (lower rates), which has historically provided a large tailwind for the duration-sensitive municipal sector. We saw similar dynamics between first lien loans and junk bonds within structured credit loan products (CLOs) even just relative to the very underlying loans themselves.

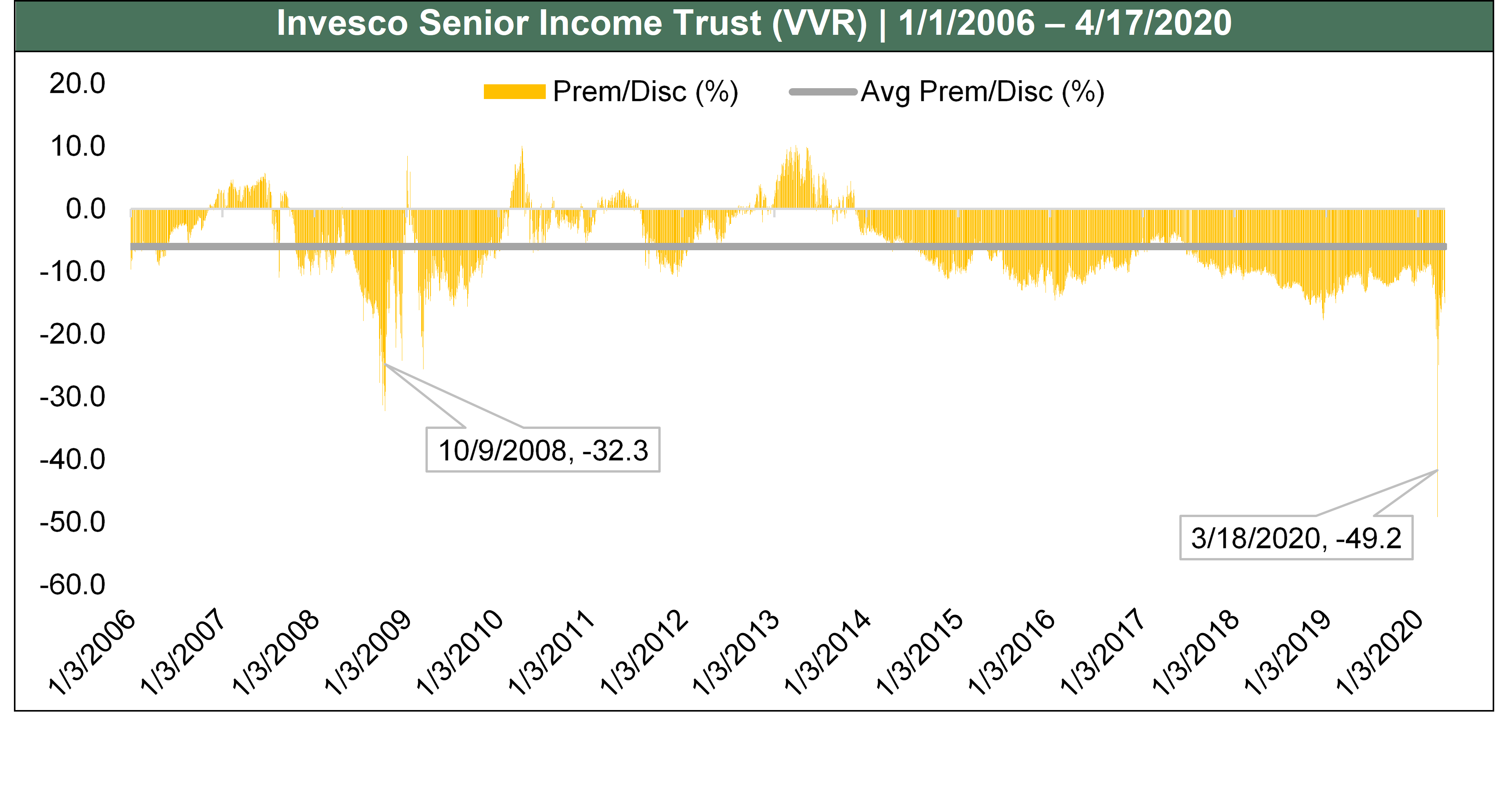

As many of you know, we are rather active in the market for Closed End Funds. While we have always highlighted that part of what generates the opportunity in that sector is that a closed end fund’s market price can dislocate from actual underlying portfolio Net Asset Value during periods of extreme volatility (as the fund trades at a “discount” to that NAV), the moves we saw in March were unmatched at any other point in history. Take, for example, the below Closed End Fund which invests in senior loans and traded down nearly 20% further than it did during the Great Financial Crisis.

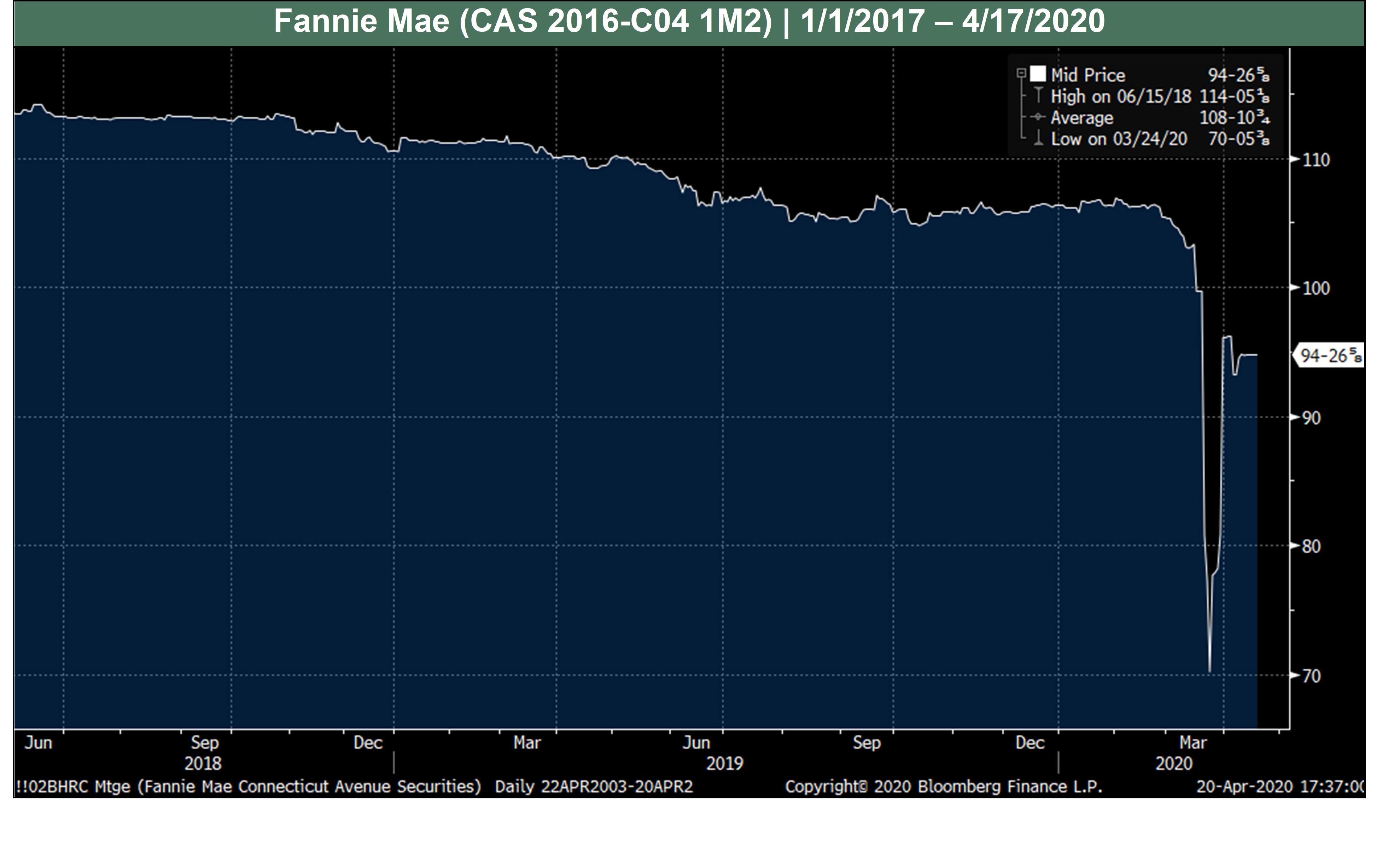

While we could keep going, we would also highlight one area that is more esoteric but important in the context of these comments on credit markets. The below chart belongs to the mezzanine tranche of what is referred to as a “credit risk transfer” or “CRT” securitization which have been issued by Fannie Mae, Freddie Mac, and Ginnie Mae going back to 2016 or so. To make a complex-sounding security simple, this bond is exposed to the credit risk of a large pool of legacy agency mortgage borrowers. Those mortgages are guaranteed by the agencies which are themselves backed by the U.S. government, as we all saw play out in the last credit crisis.

While we could keep going, we would also highlight one area that is more esoteric but important in the context of these comments on credit markets. The below chart belongs to the mezzanine tranche of what is referred to as a “credit risk transfer” or “CRT” securitization which have been issued by Fannie Mae, Freddie Mac, and Ginnie Mae going back to 2016 or so. To make a complex-sounding security simple, this bond is exposed to the credit risk of a large pool of legacy agency mortgage borrowers. Those mortgages are guaranteed by the agencies which are themselves backed by the U.S. government, as we all saw play out in the last credit crisis.

This chart begs the question of what would have driven this agency MBS security to trade from $107 to $70 in the matter of three weeks, and then back to 95 in another two weeks. The short answer is liquidity (or lack thereof) of some of these more esoteric credit assets. The forced liquidation of various mortgage REITs, which ran with very high degree of leverage to squeeze more return out of that bond when it was trading at 107, required them to liquidate large portions of their portfolios all at once.

This chart begs the question of what would have driven this agency MBS security to trade from $107 to $70 in the matter of three weeks, and then back to 95 in another two weeks. The short answer is liquidity (or lack thereof) of some of these more esoteric credit assets. The forced liquidation of various mortgage REITs, which ran with very high degree of leverage to squeeze more return out of that bond when it was trading at 107, required them to liquidate large portions of their portfolios all at once.

The Investment Research team here at Vivaldi has been busy generating as many touchpoints as possible with our underlying investment managers, particularly with those that are more directly impacted by these types of dislocations and non-economic pricing. With that said, we have recently been shifting our focus to areas of opportunity that will undoubtedly arise from these dislocations. While we believe we have been conservative in how aggressively we have moved to deploy capital in new investments out of respect for the incredibly complex nature of the current COVID-19 pandemic, we must think about areas where we would like to play offense once we are done playing defense.

*All Chart Sources: Bloomberg

Highlighted Research Process & Investment Opportunity

Those who have spoken with us know that we spend 75% of our time on bottom-up investment sourcing and diligence, while we may devote 25% of our time to thinking about the macro backdrop, mostly in the sense of that it may inform where we choose to dig for some of that bottom-up work. We often talk about how we don’t attempt to “time” markets, particularly around things such as very high-level macro metrics, including average market earnings multiples and the like. With that said, we have long been cognizant of where we thought we may lie in the broader credit cycle as the global search for yield has continued to permeate more and more corners of credit markets.

As a case in point, two of our team members recently attended an onsite meeting with a stressed/distressed municipal fund manager with whom we invest. We hold this manager in high regard when it comes to having a pragmatic and conservative view of their opportunity set through time. The firm’s founder and Chief Investment Officer lamented the dearth of more broadly available stressed municipal situations as well as the ability of even the worst municipal credits, that she believed would find themselves upside-down well before maturity, to refinance at incredibly attractive rates – materially delaying the inevitable. She attributed that activity to large international investors that were now accessing the municipal bond market as an alternative to Treasury investing where they could pick up incremental spread despite not qualifying for any of the tax-exempt interest benefit of those municipal bonds. This dynamic, paired with the elimination of the SALT tax deduction which has pushed more high-net-worth investors into municipal bonds as one of the few places they could mitigate their tax burden, seemed like it was going to keep a broader stressed opportunity set in the municipal credit space at bay for the foreseeable future. What a difference a month can make, as that team now has a full pipeline of not only stressed situations but trading opportunities around higher quality municipal bonds that are currently offering return profiles similar to the stressed situations the team was presented with just 30 days earlier. As testament to the breadth and depth of that firm’s research group, the team was able to deploy nearly 20% of the portfolio into those emerging opportunities over the last few weeks. A similar tone has been struck across many of our managers, whose opportunity sets today are becoming more vibrant than they have been in a decade. While many remain cautious in capital deployment as we gain better visibility on the future by the day, the vast majority of them have material dry powder that will allow them to play offense if and when they think they should.

Over the past years, we have attempted to align ourselves predominately with groups that shared in our more skeptical views of the broader credit environment, opting to look for niche opportunities as opposed to trying to participate in the handful of stressed/distressed opportunities that happened to exist in a smaller subset of industries or companies facing secular or cyclical challenges against a backdrop of easily accessible and relatively cheap credit. This bias on our end has left us with a sub-set of both hedge fund and longer-lock drawdown fund managers that are currently in a great position to deploy capital. The work we did to find these teams before the turn in the credit cycle (or really before it even looked likely) will hopefully pay dividends for us as we all navigate our way through this global health crisis.

We would be happy to discuss any of these credit opportunity sets and provide details on those teams that we think are best positioned to execute through this emerging cycle.

Organizational Update

Our Investment Research team is continuously dedicated to building out the bandwidth of our group in advance of the growth of our business. Most recently, Colin Pigott joined our team as a Junior Analyst, where he will provide much valued operating leverage to our broader research team as we go about our day-to-day work of staying on top of our roughly 60 underlying manager relationships while trying to source new and interesting opportunities to benefit our advisor teams and their clients. Colin joins us directly as a winter graduate from Miami University. Colin brings with him valuable experience from a handful of internships within the commercial banking and investment management sectors. While Colin has had to join our team in remote work-mode, he has persevered and demonstrated a work ethic that we identified in him during our extended interview process. We look forward to providing additional staffing updates for the team over the summer as we continue to scale to meet the needs of our advisory teams.

Amidst these unprecedented times, our primary focus is to deliver our clients the same wealth management experience they have come to expect. For the last month, our entire organization has worked remotely, and we are grateful for the energy they have committed to maintaining our strong corporate culture. We have scheduled additional internal meetings during this period to ensure that we are effectively communicating within and amongst our functional teams.

Below is a quick update:

‐ Our Advisory Team is well equipped for video conferencing and screen sharing so you can continue to have productive and interactive one-on-one discussions about your personal situations – just ask and we’ll set something up!

‐ The Client Service Team is fully operational to handle the day-to-day operations of servicing your accounts as well as those “above-and-beyond” requests. We encourage you to reach out to ClientService@vivaldicap.com or call 312.248.8300.

We are proud of our employees and the extra effort they have made to support our advisors and clients during this unusual time. We have also been pleased with the performance of our vendors, as we have not had difficulty with connectivity or accessing information. Our timeline for operating under this new normal is currently unknown and we will continue to seek the guidance of health officials to ensure that we are doing all that we can for those who are vulnerable in our many communities.

Kind Regards,

Michael Peck, CFA

President, Co-Chief Investment Officer

mpeck@vivaldicap.com

Brian R. Murphy

Portfolio Manager

bmurphy@vivaldicap.com

To download a copy of this report, click here.